January 14, 2021 | From Trump to Biden Monograph

National Economic Security

January 14, 2021 | From Trump to Biden Monograph

National Economic Security

Current Policy

The Trump administration took aggressive steps to implement a key tenet of its 2017 National Security Strategy: “Economic security is national security.”1 It achieved two core objectives: ensuring the ability of the United States to compete effectively in the long-term economic and security competition with China, and pressuring rogue states such as Iran, North Korea, and Venezuela to change their behavior and limit the threat they pose to U.S. interests.

The administration blended a wide range of tools in its economic statecraft, including extensive use of sanctions, tariffs, and export controls; a focus on protecting America’s economy through an invigorated and modernized Committee on Foreign Investment in the United States (CFIUS);2 the exclusion of foreign adversaries from U.S. telecommunications networks; and the establishment of new organizations designed to compete with Chinese foreign investment.3

A statue of Albert Gallatin, a former U.S. secretary of the treasury, faces Pennsylvania Avenue outside the department’s headquarters in Washington, DC, on April 22, 2018. (Photo by Robert Alexander/Getty Images)

Over the last two years, the United States ramped up the use of sanctions against material supporters of rogue regimes. For example, Chinese shipping companies that facilitated Iranian oil smuggling were designated;4 likewise, Russian energy firms helping Venezuela were sanctioned.5 In the Iran portfolio, in particular, the Trump administration sanctioned over 300 more targets in four years than the Obama administration did in eight.6

The administration also greatly intensified its efforts to counter China. For example, in 2020, the United States sanctioned Chinese officials in response to the passage of the National Security Law in Hong Kong;7 companies and individuals complicit in China’s militarization of the South China Sea;8 and a manufacturing organization exploiting forced Uyghur labor in Xinjiang.9

The administration’s pressure on China also employed other coercive regulatory measures. In particular, it used the Commerce Department’s Entity List to deny Chinese firms access to U.S. goods, including sensitive technologies in key industries such as semiconductors, artificial intelligence, and surveillance. The administration also issued a new executive order sanctioning publicly traded securities of Chinese military companies, aiming to starve them of their ability to access U.S. capital.

Beyond coercive measures, the COVID-19 crisis has heightened global sensitivities around Chinese-centric supply chain dependencies – from pharmaceuticals and personal protective equipment to telecommunications. This has resulted in U.S. diplomatic initiatives such as the Clean Network, designed to protect U.S. telecommunications networks from intrusion and theft.10 This effort ensures that certain Chinese enterprises cannot compromise U.S. data or infrastructure.

The administration’s focus on protecting telecommunications extended to its partners as well. To counter concerns that China is dominating the race for the widespread deployment of 5G technology, the United States pushed countries to limit their exposure to Huawei, China’s telecommunications giant.

The U.S. expansion of CFIUS resulted in aggressive screening of foreign investments for national security threats. The administration also exercised its authorities to protect the data of U.S. citizens, using its legal authorities to limit the ability of Chinese telecommunications companies such as Tencent and ByteDance (the owners of WeChat and TikTok, respectively) to operate in the United States.11

Finally, the administration moved to counter China’s Belt and Road Initiative by launching the Development Finance Corporation (DFC), which was mandated by the BUILD Act, and the Blue Dot Network, a consortium between Australia, Japan, and the United States designed to ensure transparent investment in infrastructure projects around the world. The United States also reauthorized the Ex-Im Bank and established a China-focused program designed to compete with Chinese state-backed entities.

All these efforts complemented the administration’s imposition of tariffs on hundreds of billions of dollars’ worth of Chinese goods and the “Phase One” trade deal, designed to address unfair Chinese trade practices.

Assessment

The Trump administration deserves credit for thinking holistically about national economic security and implementing policies designed to consider trade, technology and innovation, and finance as core elements of national security.

The administration’s maximum pressure campaigns on North Korea, Iran, and Venezuela placed enormous pressure on those regimes, forcing costly decisions and a search for help from outside actors. While not achieving all of the administration’s stated objectives, the measures prompted budget shortfalls and made it costlier and more difficult for these actors to engage in malign activities.

The administration also used a range of economic statecraft tools – including the threat of secondary sanctions – to enlist America’s partners and allies to counter Iran, North Korea, Russia, and China. These actions sometimes antagonized U.S. partners, animated discussions to work around U.S. measures and the use of the dollar, and undermined the credibility of sanctions based on allegations of conduct contrary to international norms. While the use of these tools may prove effective, their aggressive employment made efforts to secure cooperation more challenging with certain allies. The more sanctions are seen as tools of raw diplomacy – and not tied to malign conduct – the less effective, sustainable, and global their impact may be.

The administration deserves significant credit for focusing on the threat from China. It set the stage for sanctioning the Chinese Communist Party’s widespread theft of U.S. intellectual property, unfair trade practices, human rights abuses in Xinjiang and Hong Kong, and responsibility for the COVID-19 pandemic. More broadly, the targeting of China represented a tectonic shift. It was a marked contrast to the orthodox policy approach toward China as late as 2015, when the principal policy goals involved incorporating China as a responsible stakeholder in the international system.

The administration misstepped, however, by failing to build sustainable economic security coalitions to counter China’s aggressive activities – and to reinforce America’s standards and norms. For example, pulling out of the Trans-Pacific Partnership without filling the trade agreement gap with key Asia-Pacific partners allowed the Chinese to step in and sign the 15-member Regional Comprehensive Economic Partnership.

In addition, U.S. efforts to impose trade restrictions on its European allies made it more difficult to enlist them on countering China, which should be the national security priority. While the United Kingdom, Germany, Canada, and France, in particular, share interests in protecting their economies and technology from predatory Chinese activity, imposing tariffs on these countries strained their relations with Washington and made them less willing to create strict investment review mechanisms or to block threatening companies such as Huawei from their critical infrastructure. Likewise, the administration framed many of its protectionist trade policies under the rubric of national security, further antagonizing allies.

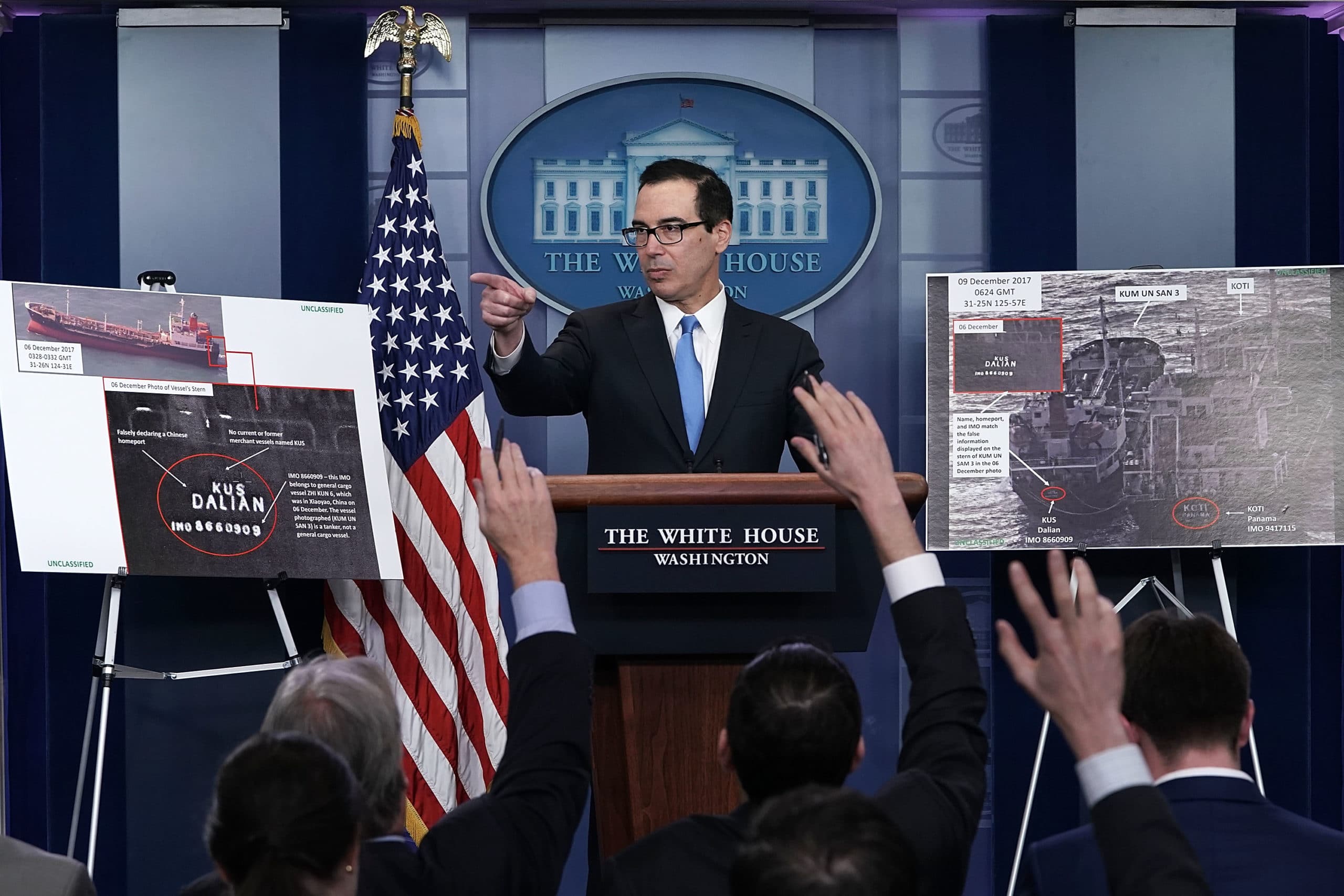

Treasury Secretary Steven Mnuchin briefs the press on new U.S. sanctions against North Korea at the White House on February 23, 2018. (Photo by Alex Wong/Getty Images)

To its credit, the administration began to address the challenges of new payment systems, greater use of digital currencies, the availability of mass amounts of financial data, and the rise of Chinese state-owned enterprises on the international scene. The administration began to respond to these changing dynamics through the development of new regulatory regimes and enforcement actions to target the illicit use of these new technologies.

Overall, the administration developed the most comprehensive and aggressive national economic security posture in memory and reshaped the approach to the China challenge. Still, significant challenges remain to build on these positive policy shifts while honing the tools of economic statecraft to ensure the primacy and sustainability of America’s economic power.

Recommendations

- Focus sanctions on rogue regimes and facilitators, especially proxies that facilitate sanctions evasion and money laundering. The emphasis should not be on coercing allies to adhere to U.S. policy goals – and there should be resistance to relying on a maximalist approach for all pressure campaigns. Sanctions should be focused on issues of recognized international security and the integrity of the financial system. The sustainability and effectiveness of sanctions will depend on their perceived legitimacy and reflection of risk to the international system, especially the private sector.

- Prioritize, sequence, and choreograph economic statecraft to promote the most important U.S. policy goals, and employ it to reinforce core partnerships in the face of broader challenges from China. Trade wars and sanctions against partners while trying to get their buy-in on key national security campaigns will alienate allies and undermine the credibility of efforts to isolate rogue behavior. Finding ways of supporting allies in the face of economic pressure from China should be a critical national security goal for the United States.

- Work closely with U.S. partners to develop financial, economic, and commercial norms and practices internationally – including transparency and accountability in financial flows, restrictions on the use of data, the protection of individual privacy rights, and anti-corrupt corporate behavior. In the face of explicit efforts by China, Russia, and others to alter international standards, the United States should redouble efforts to counter such efforts within international bodies, the financial system, and in the private sector.

- Establish information sharing mechanisms with U.S. allies to bolster investment security reviews where China, Russia, and other malign actors are trying to gain influence and access to new technologies, resources, facilities, and capital. Domestically, to ensure the transparency and security of the U.S. financial system, the United States must strengthen legal and regulatory measures to require consistent reporting of ultimate beneficial ownership and foreign investment interests. The United States should also pursue a concerted effort – through the DFC and Ex-Im Bank, among other vehicles – to invest strategically in regions, technologies, and industries deemed essential to U.S. and allied economic and national security.

- Bolster structures or create new ones along the lines of the proposed D10, a UK-led initiative that would bring together democratic nations to counter shared challenges in limiting supply chain vulnerabilities. Such efforts should also be tied to new trade deals and arrangements to help set standards in the Indo-Pacific and ensure long-term American interests are met.

- In conjunction with U.S. allies, financial institutions, and payment service providers and technologies, develop new payment platforms and capabilities that facilitate international cross-border payments and financial inclusion, ensure transparency, and reinforce the centrality of U.S.-based payment systems. In concert with major economies and banking centers, U.S. and allied payment systems and technologies should be developed, expanded, and supported in the face of expansive Chinese payment systems.

- Conduct a review of how U.S. adversaries, international market conditions, new technologies, and fiscal and monetary policies are affecting the attractiveness of the U.S. dollar as the leading trade and reserve currency. This review should yield a strategy to reinforce the use of and reliance on the U.S. dollar internationally – in traditional and novel ways, including the development of stablecoins and central bank-backed digital currencies.