October 10, 2019 | Policy Brief

Despite Sanctions, Iran Exports Hundreds of Millions Worth of Polyethylene to China

October 10, 2019 | Policy Brief

Despite Sanctions, Iran Exports Hundreds of Millions Worth of Polyethylene to China

Abdolnasser Hemmati, the head of the Central Bank of Iran (CBI), announced last week that from March to September 2019 the CBI managed to provide $19 billion to pay for Iran’s imports, of which $11 billion came from the proceeds of its non-oil exports. According to Iran’s customs organization, Tehran exported $21 billion of non-oil goods in the aforementioned period, 10 percent less than in the same period the previous year. Assuming their accuracy, these figures indicate that Washington’s success in reducing Iran’s oil exports has not extended to other valuable export commodities, including the key petrochemical polyethylene.

Petrochemical products are among Iran’s top non-oil exports even though the industry has labored under sectoral sanctions since November 2018. Previous FDD analysis showed that in its first four months under sanctions, Tehran’s average monthly export of petrochemicals dropped by 18 percent in comparison to its level during the seven months before sanctions. According to Iranian customs data, in the last full year of the Persian calendar (March 2018 – March 2019), $14.1 billion of Iran’s non-oil exports, or 32 percent of the total, came from the petrochemical sector. Within that sector, $3.4 billion, or 24 percent, came from polyethylene, the most common plastic in the world, whose primary use is in packaging. In the March 2018-March 2019 reporting period, Iran exported $2.7 billion of polyethylene, or 80 percent of the total, to China.

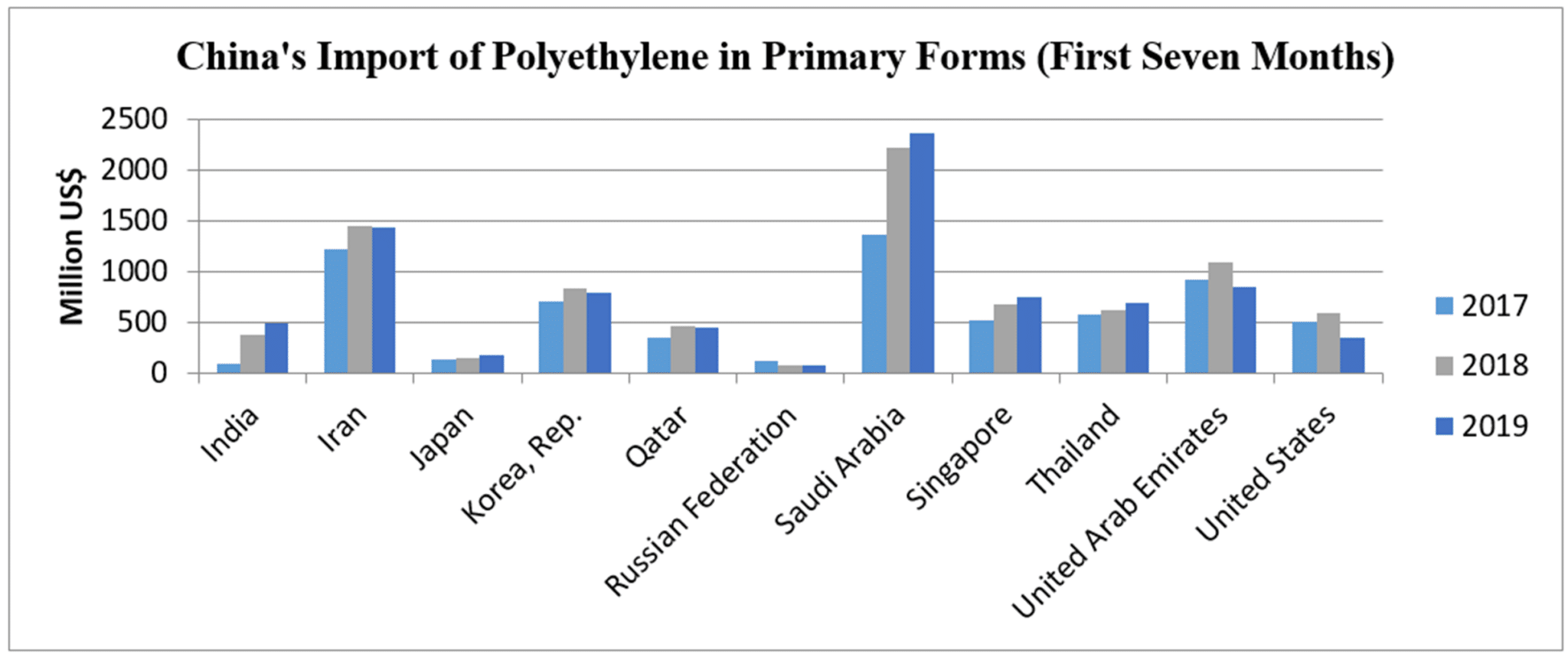

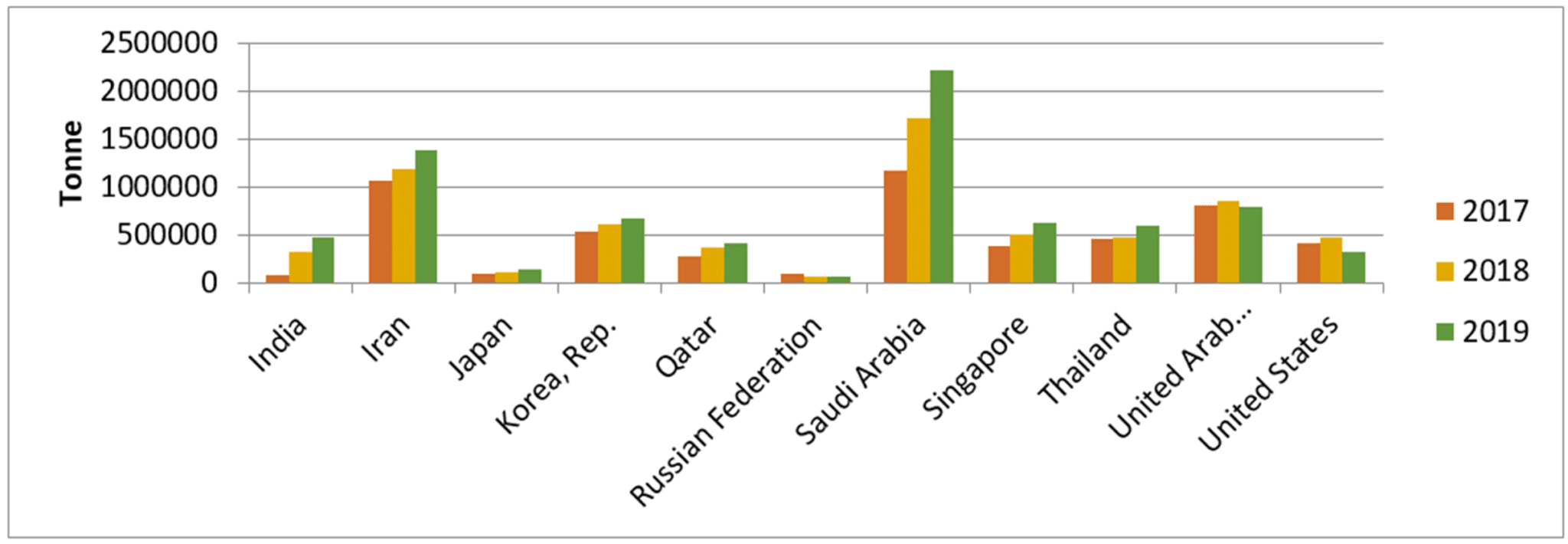

Beijing is the largest importer of polyethylene in the world. According to the China Customs Organization, in 2017, China imported $14.2 billion worth of polyethylene. The top seven exporters of polyethylene to China that year were Saudi Arabia, Iran, the United Arab Emirates, South Korea, Singapore, Thailand, the United States, and Qatar. These seven supplied 80 percent of China’s polyethylene imports, with Iran accounting for 16 percent of the total, or $2.24 billion.

The latest Chinese data shows that, in the first seven months of 2019, China imported $1.43 billion of polyethylene from Iran, an amount comparable to its imports during the corresponding period of 2018 and higher than those in the corresponding period of 2017. In terms of weight, China’s imports of polyethylene from Iran have increased significantly, rising from 1.2 million tons in the first seven months of 2018 to 1.4 million tons in the same period of 2019.

This data attests to the limited impact of U.S. sanctions on the polyethylene trade with China, the main customer for Iran’s polyethylene. If this remains the case, Iran is likely to export $2-2.5 billion of polyethylene to China this year, resulting in a valuable injection of hard currency that alleviates the impact of the U.S. maximum pressure strategy.

The data suggests that Iran has not had to discount its exports in order to maintain its market share in China. Chinese figures show that the ratio of the Iranian selling price to the Saudi selling price for polyethylene has barely changed. In fact, the relative price of Iranian exports has risen slightly. In other words, Iran is not compensating for sanctions by lowering prices. (See table below)

| The ratio of Iran’s selling price to Saudi Arabia’s selling price for polyethylene | |||

| Product/Year | 2017 | 2018 | 2019 |

| Polyethylene having a specific gravity <.94, in primary forms | 0.98 | 0.98 | 0.99 |

| Polyethylene having a specific gravity >0.94, in primary forms | 0.96 | 0.92 | 0.96 |

| Linear low-density polyethylene having a specific gravity <0.94, in primary forms | 0.92 | 0.96 | 0.96 |

If the United States truly wants to apply the maximum pressure its strategy calls for, then Washington should move quickly to cut Tehran’s polyethylene exports, especially those to China. As a first step, the U.S. Treasury should reiterate that polyethylene imports are prohibited, and should add to its sanctions list the Iranian companies that produce the chemical. Despite the blanket industry sanctions, the majority of Iranian petrochemical companies are not on the list. Next, Washington should discuss with China and other importers how they could find alternate sources of polyethylene. If China demonstrates a willingness to cooperate, the U.S. can follow the precedent it set regarding crude oil, whereby it facilitated a transition to new sources of supply by issuing temporary waivers that approved the continuation of imports at a reduced level. If Chinese firms resist – as some of them have in the case of crude oil – Treasury should punish them to demonstrate that a failure to comply has significant costs.

Saeed Ghasseminejad is a senior Iran and financial economics advisor at the Foundation for Defense of Democracies (FDD), where he also contributes to FDD’s Center on Economic and Financial Power (CEFP). Follow Saeed on Twitter @SGhasseminejad. Follow FDD on Twitter @FDD and @FDD_CEFP. FDD is a Washington, DC-based, nonpartisan research institute focusing on national security and foreign policy.