August 13, 2019 | Policy Brief

Inflation in Iran Reaches 23-year Peak

August 13, 2019 | Policy Brief

Inflation in Iran Reaches 23-year Peak

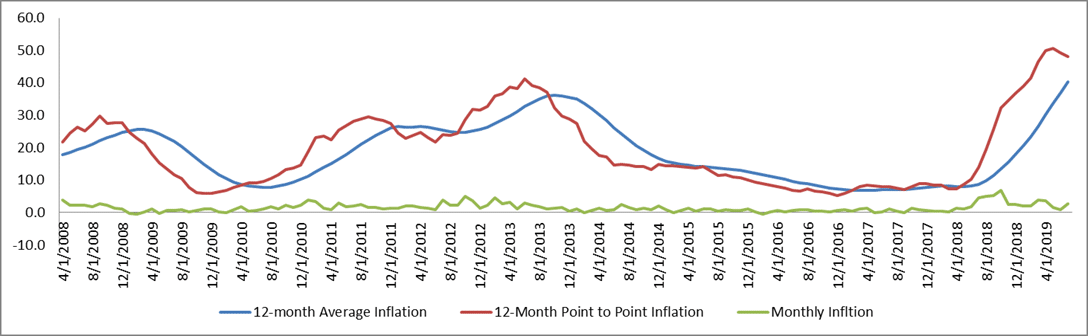

In July 2019, Iran’s 12-month average inflation reached 40.4 percent, according to the Statistical Center of Iran. This is Iran’s highest inflation rate in 23 years, well above the peak inflation rate of 36.2 percent in October 2013 before the announcement of the Joint Plan of Action interim nuclear deal. Whether inflation will rise further depends on a number of factors, including the rial exchange rate, Iran’s access to hard currency, the country’s exports, the stability of its financial system, and the regime’s ability to import essential consumer and capital goods.

The twelve-month average for inflation, also called the ‘annual average’ or ‘year–to–year inflation,’ is frequently used to compare the average consumer price index (CPI) for a given 12-month period to the average CPI from the previous 12-month period. Since April 2018, Iran’s twelve-month average inflation has risen steadily from 8 percent in April 2018 to 40.4 percent in July 2019 – a level not reached since July 1996, when Iran’s 12-month average inflation rate hit 39.5 percent. However, Iran’s all-time record remains 50.9 percent, reached in January 1996when then-President Akbar Hashemi Rafsanjani’s adjustment policies sparked high inflation.

A closer look at other macroeconomic variables does not rule out that inflation could exceed the current 40.4 percent rate.Month-to-month data from May through July 2019 suggest that there could be yet another wave of inflation coming.

Other macroeconomic developments also paint a grim future for Tehran. Since May 2019, when the United States revoked all oil-waivers for Iran’s oil customers, Tehran’s export of oil has significantly dropped, although the exact numbers are not readily available. Oil accounts for the largest share of Iran’s exports.

Tehran’s second most valuable export, petrochemical products, has also been under U.S. sanctions since November 2018. Tehran has seen a drop there, too. Meanwhile, tightening sanctions on Iranian banks have made it more difficult for Tehran to repatriate its export revenues, thereby decreasingTehran’s access to hard currency.

Tehran is now flirting with the options of cutting the indirect subsidies it has traditionally offered the population for essential goods and of establishing a higher exchange rate on the rial. Both moves are necessary for long–term structural reform in Iran’s economy, but in the short term these moves could lead to higher inflation at a time when it is already skyrocketing. To make matters worse, the regime is struggling with all of this during a time of recession. Indeed, the combination of a recession with high inflation is the dreaded phenomenon known as “stagflation.”

The Islamic Republic may be able to delay economic collapse by tapping into its currency reserves, cutting infrastructure spending, and bypassing sanctions to the extent that it can. But as time passes, its diminishing currency reserves and lack of foreign and domestic investment will almost certainly sap employment numbers, weaken domestic supply lines, and inhibit the import of consumer and capital goods. This, in turn, would once again put the regime in danger of financial collapse.

Despite Tehran’s insistence that it will not negotiate with Washington, doing so appears to be the only surefire way to avert economic disaster. While the Trump administration has offered to engage repeatedly, the regime has rejected all those overtures. Given Tehran’s growing economic crisis, the administration should maximize its maximum pressure campaign and not be overly anxious for a deal.

Saeed Ghasseminejad is a senior Iran and financial economics advisor at the Foundation for Defense of Democracies (FDD), where he also contributes to FDD’s Center on Economic and Financial Power (CEFP). Follow Saeed on Twitter @SGhasseminejad. Follow FDD on Twitter @FDD and @FDD_CEFP. FDD is a Washington, DC-based, nonpartisan research institute focusing on national security and foreign policy.