April 19, 2024 | Policy Brief

Iran’s Oil Exports Continue to Rise

April 19, 2024 | Policy Brief

Iran’s Oil Exports Continue to Rise

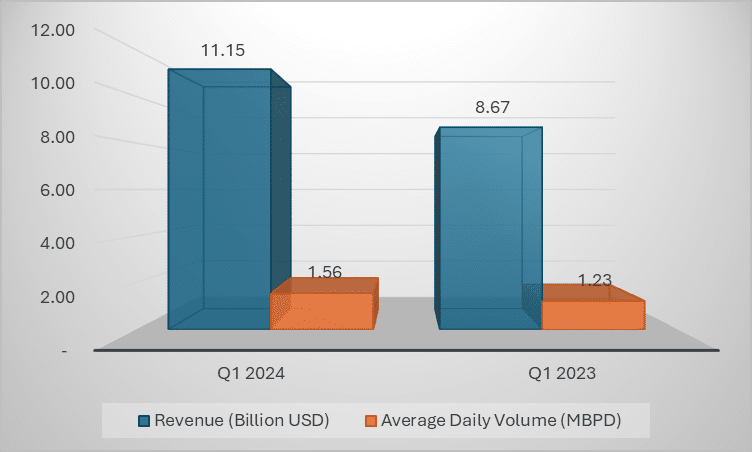

Iran exported 141.7 million barrels of oil during the first quarter of 2024, a 28 percent increase over the same period last year. Increased oil exports enhance Tehran’s currency reserves and enable it to support its military industry and proxies as it escalates tension with Jerusalem.

In March 2024, Iranian exports reached 1.82 million barrels per day, the highest rate since October 2018, just before the Trump administration reinstated oil sanctions. Export growth substantially impacts Tehran’s budget since oil exports accounted for more than 40 percent of Iran’s total export revenue in 2023.

Tehran presumably sells its oil at a discount to compensate buyers for the risk of engaging in transactions that violate U.S. sanctions. Assuming Iran’s price floor is 15 percent below the price of Brent crude and its ceiling is a five percent discount, Tehran earned between $10 billion and $11.1 billion from January to March 2024 — an amount in excess of the Islamic Revolutionary Guard Corps’ official budget.

Since President Joe Biden assumed office, total Iranian oil exports have exceeded $100 billion, which is greater than the annual budget of Greece or Ireland. Had Tehran’s average daily export volume remained the same as it was while Donald Trump’s maximum pressure policy was in effect from May 2019 to January 2021, the regime would have had $40 billion less to spend on ballistic missiles and proxy groups.

In addition, the Biden administration has allowed Iran access to $16 billion in euros that are part of its reserve but held outside the country. Given that money is fungible and Tehran still does not have full access to its currency reserve, this $16 billion significantly increased the regime’s ability to invest in malign activities.

The majority of Tehran’s exports go to China, which now purchases between 80 percent and 90 percent of Iran’s oil.

The Biden administration’s disinterest in enforcing or even applying sanctions to curtail Iranian revenue represents a missed opportunity for diplomacy, as it has allowed the Islamic Republic to increase its exports without making any concessions on its oppression at home, its nuclear and conventional proliferation, or its support for proxies and terrorist organizations.

Iran’s increased financial firepower translates directly into instability in the West Bank and Gaza Strip, Lebanon, Yemen, Iraq, and Syria, as the Islamic Revolutionary Guard Corps funds its proxies and augments their arsenals.

After Iran’s drone and missile barrage on Israel, Biden and his European partners now urge diplomacy and restraint. Such a strategy — absent a willingness to target Iran’s oil exports and the regime’s access to revenue — is incoherent, as a failure to sanction tankers, banks, refineries, and front companies signals to Iran that it will pay no economic price for aggression.

Saeed Ghasseminejad is a senior advisor on Iran and financial economics at the Foundation for Defense of Democracies (FDD), where he contributes to FDD’s Iran Program and Center on Economic and Financial Power (CEFP). Follow Saeed on X @SGhasseminejad. For more analysis from Saeed and FDD, please subscribe HERE. FDD is a Washington, DC-based, non-partisan research institute focusing on national security and foreign policy.