October 30, 2019 | Policy Brief

Sanctions Have Not Reduced Iran’s Pharmaceutical Imports From EU, Data Show

October 30, 2019 | Policy Brief

Sanctions Have Not Reduced Iran’s Pharmaceutical Imports From EU, Data Show

Despite sanctions, Iran’s imports of European pharmaceuticals increased in the first half of 2019 compared to the first half of the year prior. This trend suggests the exemption of humanitarian goods from U.S. sanctions has enabled Iran to meet its needs, despite Iranian lawmakers’ complaints that Washington has disrupted their access to medicine and medical equipment.

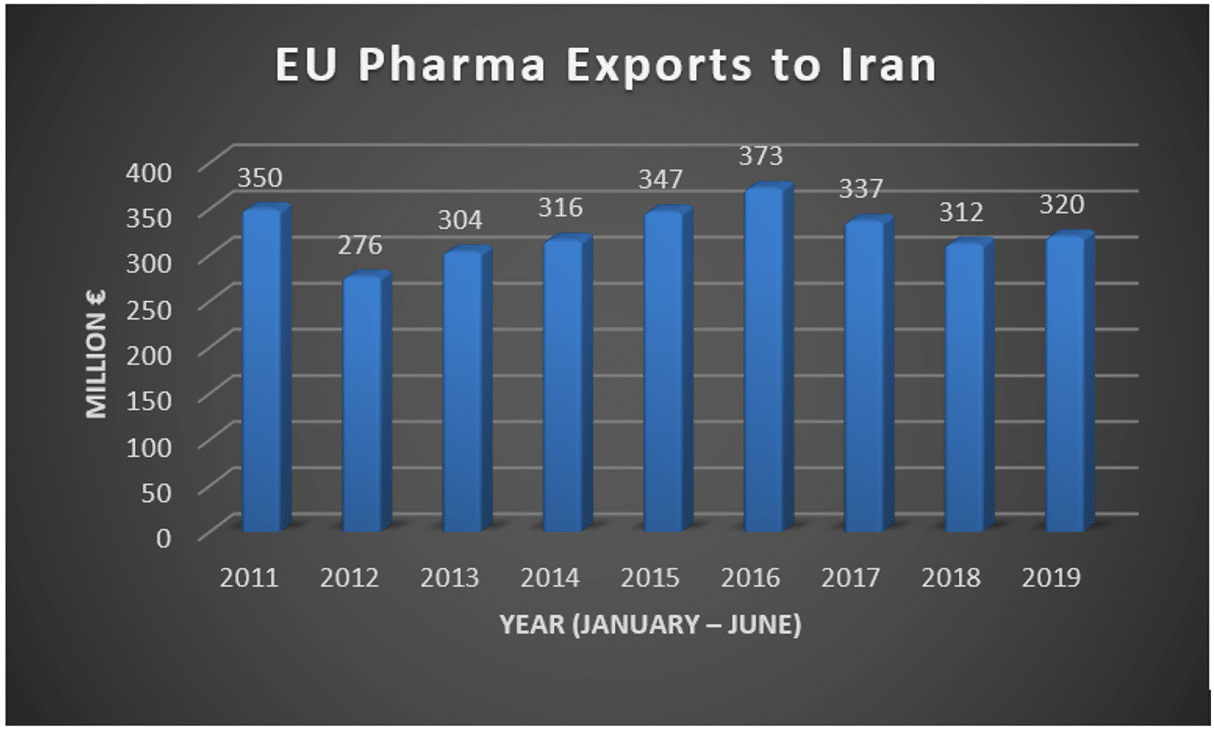

Tehran imported €320 million of pharmaceutical products from EU countries in the first half of 2019, an increase of 2.5 percent compared to the first six months of 2018, but slightly less than the total for January through June of 2017. While the U.S. withdrew from the Iran nuclear deal in May 2018, the Treasury Department only reinstated most sanctions that November, so it makes sense to compare the first halves of 2018 and 2019.

Eurostat, the EU statistical office based in Luxembourg, collects and publishes import and export data based on reporting by the Union’s 28 member states. Iran’s €320 million of pharmaceutical imports during the first half of 2019 is about 16 percent higher than the amount imported during the first half of 2012, the height of sanctions under the Obama administration. Pharmaceutical imports then grew continually from 2013 to 2015 before peaking at €372 million in 2016 after the removal of sanctions.

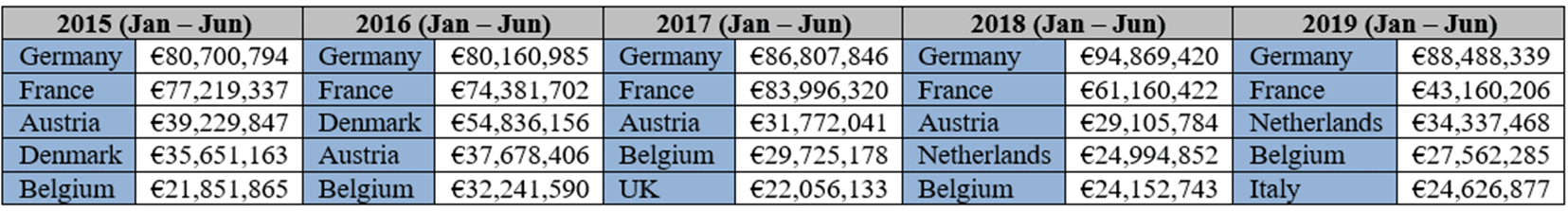

The top five exporters of pharmaceutical products to Iran in the first half of 2019 were Germany, France, the Netherlands, Belgium, and Italy. Germany and Belgium maintained a stable level of exports over the last five years, while exports from other nations showed greater volatility. It is difficult to determine whether these fluctuations were related to sanctions, since French exports began to fall substantially in 2018 before sanctions returned, while Dutch exports continued growing in 2019 even after sanctions came back.

Top Five Pharma Exporters to Iran

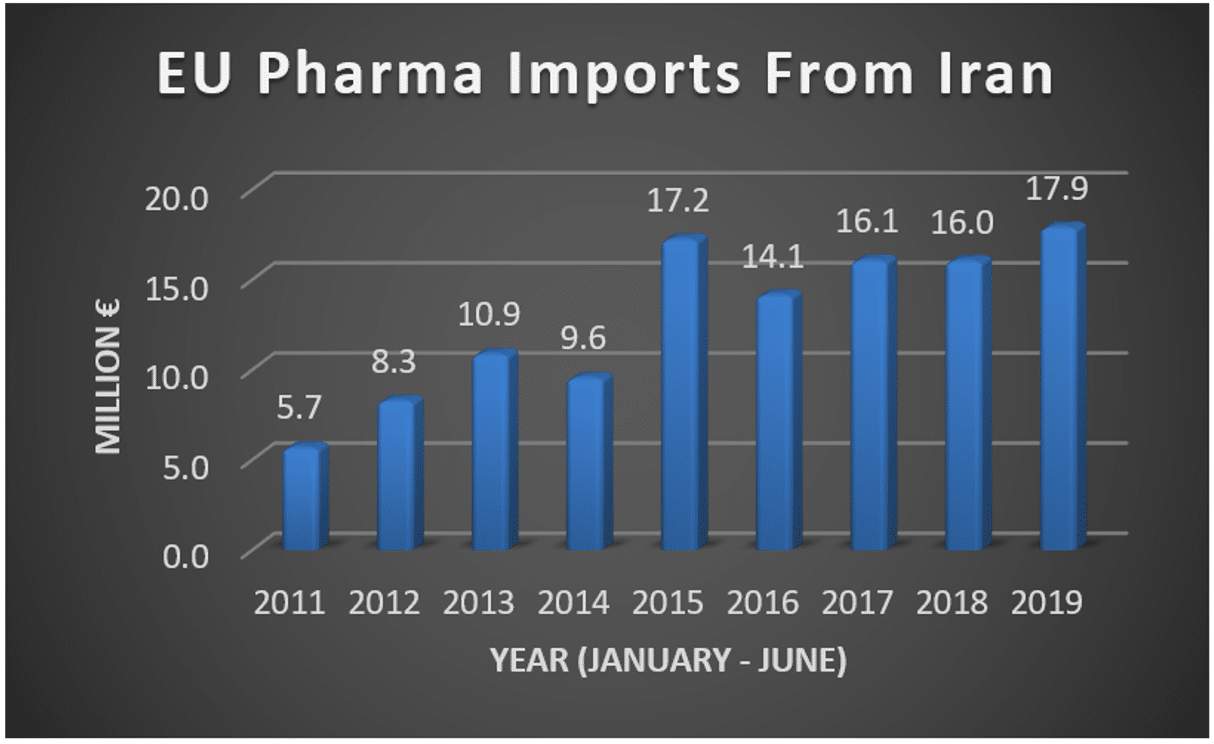

Eurostat data also covers EU imports of pharmaceuticals from Tehran, whose value is less than 5 percent of EU exports. EU imports from Tehran actually peaked in the first half of 2019, at €18 million, which exceeds figures for the 2016 – 2018 period, when sanctions were not in effect. Germany is Tehran’s chief customer, taking 92 percent of EU imports from Iran this year.

Section 1245 of the National Defense Authorization Act of 2012 imposed broad sanctions on Iran’s financial sector but prohibited the president from imposing sanctions on “agricultural commodities, food, medicine, or medical devices.” The Treasury Department in 2013 issued detailed guidance affirming these exceptions, and the department regularly updates its Frequently Asked Questions page to address specific queries from interested parties.

Nonetheless, media reports have emphasized the view of critics that U.S. sanctions have a “chilling effect” that deters financial institutions from processing legitimate transactions. Yet the greater problem is a lack of legitimate partners in Tehran because the regime has corrupted the financial system so thoroughly. Consequently, the Treasury Department in 2011 designated all of Iran as a jurisdiction of primary money laundering concern.

In response to concerns about the alleged chilling effect, the Departments of State and Treasury announced a new mechanism this week to facilitate and bring greater transparency to permitted trade with Iran. Foreign governments and financial institutions that choose to participate will commit to detailed reporting about their transactions with Iranian partners and can seek “written confirmation from Treasury that the proposed financial channel will not be exposed to U.S. sanctions.”

This new mechanism holds considerable promise as a means of preventing Iran from evading sanctions by abusing humanitarian channels; in the past, Tehran disguised billions of dollars of illicit transactions as humanitarian trade. At the time, the regime also blamed sanctions for shortages, yet the regime’s corruption was the main cause of its people’s misery. As the EU data show, sanctions have not disrupted pharmaceutical imports, so corruption may once again be contributing to shortages.

David Adesnik is director of research at the Foundation for Defense of Democracies (FDD), where Saeed Ghasseminejad is senior Iran and financial economics advisor. They both contribute to FDD’s Center on Economic and Financial Power (CEFP). Follow them on Twitter @adesnik and @SGhasseminejad. Follow FDD on Twitter @FDD and @FDD_CEFP. FDD is a Washington, DC-based, nonpartisan research institute focusing on national security and foreign policy.