April 30, 2019 | Policy Brief

Inflation in Iran is on the Rise

April 30, 2019 | Policy Brief

Inflation in Iran is on the Rise

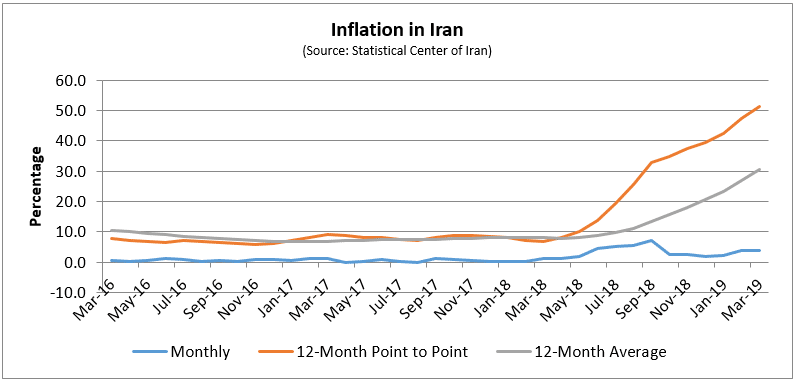

The Statistical Center of Iran published its latest update last week on the country’s inflation rate. It reported an average yearly inflation of 30.6 percent and a 12-month point-to-point inflation of 51.4 percent. Both figures have increased sharply since the U.S. withdrawal from the nuclear deal in May 2018, indicating the substantial macroeconomic impact of the Trump administration’s maximum pressure strategy.

The average yearly inflation rate measures the change in the consumer price index (CPI) between one 12-month period and the previous 12-month period. The country’s point-to-point inflation rate measures the change in the CPI for a particular month in comparison with the same month in the previous year. The chart below compares these two measures of inflation over the past three years, while showing the monthly inflation rate as well.

In April 2018, the last full month before U.S. withdrawal from the nuclear deal, the average yearly inflation rate in Iran was 8 percent, a figure that had changed little for over two years. The point-to-point inflation rate in that period was similar.

The latest numbers send a worrisome signal to Tehran because they show the diminishing effect of its intervention in the foreign exchange market as a means of suppressing inflation. In April 2018, Iran’s monthly inflation rate was 1.1 percent. As the rial depreciated, the monthly rate rose to a high of 7.1 percent in September. In the summer of 2018, Tehran moved to suppress demand and increase supply in the foreign exchange markets, which held the rate down to 2.6 percent or lower from October through January – still high, but tolerable. Then, monthly inflation rose to 3.9 percent in February and 4.0 percent in March.

The latest numbers show that the cost of food has risen especially quickly, with a 12-month point-to-point increase of 85.2 percent. The price increases have been greatest for meat (116 percent), fruits (111.6 percent), and vegetables (157 percent). Tehran’s efforts to subsidize food and agriculture via favorable exchange rates for importers have not had the desired effect, likely because of deeply rooted corruption. Also, the psychological effect of rising food prices may be especially great because of how frequently consumers make such purchases.

In contrast to rising food prices, the point-to-point inflation rate for utilities (29.4 percent), housing rent (24.7 percent), and healthcare (27.2 percent) are among the lowest. However, one should take the healthcare numbers with a grain of salt since many healthcare providers demand payment in cash and charge well above the regulated price without reporting it.

The weakness of the Iranian economy extends far beyond inflation and a devalued currency. The IMF forecasts that the current recession will worsen this year, leading to a 6 percent contraction of GDP.

Inflation is likely to continue rising as Tehran’s revenue from oil exports decreases and its accessible currency reserves diminish. The regime is likely to address public frustration by reallocating scarce resources from infrastructure projects to essential consumer goods; this may lower prices, but will likely increase unemployment while preventing growth driven by public investment.

The continuation of a true maximum pressure campaign will force Tehran to choose between the survival of the regime and the surrender of its plans for regional domination. Washington should continue to pressure Tehran and its proxies in the region and not rush to the negotiating table. Patience is the key to victory.

Saeed Ghasseminejad is a senior Iran and financial economics advisor at the Foundation for Defense of Democracies (FDD), where he also contributes to FDD’s Center on Economic and Financial Power (CEFP). Follow Saeed on Twitter @SGhasseminejad. Follow FDD on Twitter @FDD and @FDD_CEFP. FDD is a Washington, DC-based, nonpartisan research institute focusing on national security and foreign policy.