July 26, 2023 | Congressional Testimony

Commanding Heights: Ensuring U.S. Leadership in the Critical and Emerging Technologies of the 21st Century

July 26, 2023 | Congressional Testimony

Commanding Heights: Ensuring U.S. Leadership in the Critical and Emerging Technologies of the 21st Century

Download

Full written statement for the record

Executive Summary

The United States is in the throes of a long-term, peacetime competition against a Communist threat.[1]

This is a competitive dynamic not unlike that of the Cold War. But this is not the Cold War. The world is different; so is the adversary. The threat posed by the Chinese Communist Party (CCP) presents a new strategic challenge: The reality of today’s economic trends (i.e., globalization) and technology trends (e.g., information technology) means that the Cold War playbook of containment cannot be relied upon against the CCP.

China’s “State led, Enterprise driven” approach to economic competition and “military-civil fusion”[2] strategy for power projection demand a new strategic response from the United States. The emerging technology competition, one of the most critical fronts in today’s great power face off, offers a microcosm of this reality and need. It is insufficient – and in many instances self-defeating – to assume that the US-China technology competition is a straight-forward innovation race. Beijing’s strategy subverts traditional assumptions and modes assumed by that strategic framing. US policy should orient around a strategy of activation – rather than containment – with key lines of effort aimed at:

- Revitalizing technology and investment defenses better to target core nodes of China’s system;

- Catalyzing American technological leadership from private sector excellence;

- Aligning offensive and defensive actions (e.g., promotion and protection of technology development);

- Embracing strategic alignment in diplomatic partnerships that will catalyze offense-defense elision, activate private sector excellence, and enable allied and partner targeting of core nodes of China’s technology acquisition program and military-civil fusion strategy;

- Defending in depth via signals to markets of the long-term costs associated with surrendering technological competitiveness to China.

The written testimony that follows addresses the character of today’s strategic competition, background on China’s approach to emerging technology and the CCP’s military-civil fusion strategy for converting science and technology (S&T) for military ends. The conclusion of this testimony advances a series of recommendations for directing US policy efforts to target core nodes in the PRC S&T system as a part of a broader strategy for long-term, peacetime competition.

The Strategic Context

Today’s strategic context is shaped as much by the adversary as it is by economic and technology trends.

The CCP has learned from the Cold War experience of the Soviet Union. Generations of Chinese political leaders have crafted an approach to economic development that solves for many of the structural vulnerabilities that contributed to the Soviet Union’s demise. Chinese political leaders have also developed their strategy, system, and positioning based on study of the United States in order asymmetrically to target US weaknesses and neuter US strengths. Beijing’s “State led, Enterprise driven” approach to economic competition integrates strategic and economic returns; the national-level strategy of “military-civil fusion” guarantees that China’s economic positioning delivers progress for military modernization and power projection. This approach is uniquely valuable for China in today’s era of economic globalization. Altogether, these PRC strategic concepts amount to a competitive strategy that has been operationalized via a deliberate and sustained industrial policy.[3]

In sum, China’s approach is designed for today’s competitive environment and their rival, namely the United States. And China’s approach has proven able to target relative US weaknesses – as evident in acute supply chain dependencies, quantitative advantages in regional military arsenals, unbridled misinformation campaigns, and a concurrent and reinforcing narrative of Chinese ascendence.[4]

That said, the United States retains numerous enduring comparative strengths vis-à-vis China. But they are all too frequently frustrated, if not neutralized or rendered counter-productive, by Beijing’s asymmetric integration into global markets.

China’s Competitive Strategy for Emerging Technology

US framings of the US-China emerging technology competition often suffer from one central misconception: Conventional Western analysis assumes that Beijing’s parasitic technological siphoning is a short-term fix and a sign of relative weakness. As this conventional wisdom has it, Beijing wants to out-innovate the United States, according to traditional Western economic definitions of innovation. China will only rely on siphoning foreign technologies until it can develop its own: It steals to reach parity so that it can then compete symmetrically to rival global leaders in inventing advanced R&D.[5]

This hypothesis predicts that as Beijing develops S&T capacity – largely through international engagement – it will increasingly devote its attention to basic and fundamental areas; not to transferring technologies from abroad, but to inventing them at home. Chinese messaging to the United States encourages this mirror-imaging. Beijing tells its interlocutors in Washington that its “indigenous innovation” is modeled after the developed world’s approach to fundamental inventive capacity.

Conventional analysis also assumes that inferior capacity in basic or theoretical S&T constitutes an inherent strategic disadvantage for China; that dependence on advanced technology outweighs, as a weakness, dependence on markets or manufacturing capacity. That assumption may underestimate the extent to which international R&D ecosystems are integrated.[6] It may also underestimate the distinction between competing over invention and competing over its application in the current period. At the least, it risks failing to account for China’s distinctive strategy and its asymmetric approach to the modern technological contest.

Both Chinese discourse and resource allocations suggest that Beijing’s reliance on technology siphoning might be a long-term, enduring orientation and one that complicates framings of the strategic competition as an innovation race. This PRC orientation is not a stopgap measure. It is consistent across the last 40 years at the level of the strategic posture of the Chinese State’s government S&T ecosystem.[7] Beijing competes in emerging technology not by inventing innovative technology but by transferring it from abroad and applying it first, and to scale. China’s approach draws on enduring comparative advantages: a massive population of relatively low-cost labor, centralized regulatory authorities that can overlook and obscure occupational safety and environmental hazards while also guiding and restricting commercial activity, and the promise of a massive domestic market that reliably attracts foreign investment and technology.

This asymmetry has direct implications both for measuring the emerging technology competition and for developing responsive policy. As long as the United States frames the emerging technology competition with China as an innovation race, it will compete by pouring resources into basic research and development. But if the PRC is positioned to benefit from that R&D – and is competing by applying it, at relatively lower cost and lower risk – then US policy risks fueling China’s competitive strategy.

Investing in Applications

China’s particular innovation model is born out in official resource allocations. Beijing’s investments in S&T have increased dramatically over the past two decades. This trend is often cited as evidence of China’s push for innovative capacity and pursuit of fundamental S&T breakthroughs – and according to US and Western economic definitions thereof. But the reality is that the PRC’s investments revolve disproportionately around scaling approaches and technologies that have already been developed abroad and proven to meet commercial needs. Chinese statistics reveal no emphasis on basic and applied research to match that thrust in US S&T ecosystems. The resultant strategic dynamic: Foreign partners shoulder high-risk, high-cost invention of emerging technology; China acquires it and then competes for applications of advanced technologies after sitting idly downstream with a more advantageous cost profile.

Compared to developed economies, China invests little in fundamental S&T or basic R&D. This is true across commercial, governmental, and military domains. According to statistics from China’s Ministry of Science and Technology, Beijing spends only about 10 percent of its R&D funds on basic research. That ratio has been largely constant over the past 20 years. Other developed economies spend upwards of 70 percent of their R&D on basic research in particular fields.[8] It is fair to note that these data sources are somewhat limited and difficult to validate independently or across the entire gamut of sectors of the Chinese private sector and official government spending. However, these data sources are borne out in more granular Chinese empirics, including in the priorities reflected in national-level prizes for science and technology.

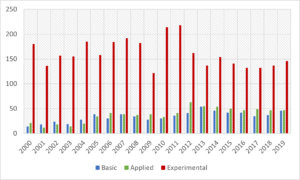

Beijing rewards and encourages S&T development through an institutionalized process: Every year between 2000 and 2020, the Ministry of Science and Technology (MOST) awarded some 200 researchers and teams prizes for outstanding achievements in S&T. Candidates were recommended by provinces, ministries, and institutions (e.g., the Chinese Academy of Sciences).[9] The vast majority of those awards went to a category that maps on to experimental research and development, with the smallest number going to a category aligned with basic research and development. These prizes are meant to bestow prestige; the prioritization they reflect is that prestige in China’s S&T community disproportionately resides at later stages of technology application and commercialization and far less so at anything resembling proper basic research. This trend tracks closely with China’s focus in research and development spending as well.

Chinese S&T Prizes by Type, 2000-2019 (unit = number of awards)[10]

Organizationally speaking, Beijing has crafted its S&T institutions around international cooperation. MOST established a Special Office for International S&T Cooperation in 2001.[11] Between 2001 and 2005, the Special Office launched a total of 677 international S&T cooperation projects. It led investment of some 8.439 billion RMB (about 1.2 billion USD) in international S&T cooperation.[12] When MOST refreshed the five-year planning for international S&T cooperation in 2006, it made foreign S&T cooperation and exchange a priority for the entire range of national S&T plans, programs, and priorities – the National Science Foundation, 211 and 985 projects, and national high-tech research and development plans. This classified S&T cooperation as a military as well as a civilian tool: Foreign targets were to be selected according to national development plans and projects, but also national security requirements.[13] The 2017 edition of the Five-Year Plan for International S&T Cooperation added a new layer of centralized, top-level organization and oversight that has extended these trends.[14]

An Asymmetric Application Race for Asymmetric Dependence

Beijing’s reliance on technology acquisition and application rather than invention rests on a calculus about the modern globalized environment, the emerging technology competition taking place within it, and China’s relative strengths and weaknesses.

Chinese industrial planning, assumes, first, that military and civilian innovative resources are easy to acquire from the international system. Second, Chinese planners recognize that in a world of technological exchange, technological value can be derived from scaled applications of emerging technology, as well as asymmetric leverage over emerging technology supply chains, rather simply than basic invention. Third, Chinese industrial planners assume that they can keep domestic markets and resources relatively insulated while penetrating and siphoning foreign ones.

Qiaohai Shu of the Chinese Academy of Social Sciences explained the preference for enduring reliance on foreign innovation in 2011:

China’s technological innovation cannot catch up with the developed countries in the West…It is necessary to find another path…It is not only time-consuming and laborious to bet on innovation, but also risky. However, at the level of technology application, the gap between domestic and foreign is small, and the opportunity cost of surpassing low. Moreover, the chances of getting the desired result are greater.[15]

As Hou Qiang of Jiangsu Institute of Technology’s Institute of Marxism puts it in a paper supporting Beijing’s National Social Science Planning Project, Beijing deploys a “one-sided strategic policy in international high-tech cooperation.”[16] The one-sidedness refers to China’s ability to use cooperation to obtain, but not share, advanced technology. This strategy manipulates access to today’s open, global system to acquire cutting-edge innovation at low-cost and low risk. Thus positioned, Beijing can focus on deploying and applying the advanced S&T it acquires from abroad for competitive advantage.

Chinese industrial planners are explicit that they intend not only to apply the technology from abroad for commercial ends and immediate economic return. The goal is to control the larger, global industrial fabric by developing control of chokepoints.[17] Beijing seeks to sow dependence and seize strategic positioning in value chains (as, for example, reflected in market share held by Chinese champions) rather simply than to claim immediate economic return or growth tied to short-term profits.[18] Per Chen Jinming of the National Development and Reform Commission, “in some strategic markets, market share is more important than short term profit.”[19] The CCP targets access to and leverage over strategic assets – ranging from scarce resources to key civilian and military infrastructure.[20] Per the China Development Bank, investment overseas allows Beijing to “strengthen economic ties,” therefore dependence;[21] to expand its material exports while importing advanced technology.[22]

These points rest on a long-standing calculus about globalization codified in the decades-old “Two Markets, Two Resources” (两个市场, 两种资源) strategic theory.[23] First advanced in official CCP discourse in 1981,[24] Two Markets, Two Resources serves as a core theoretical underpinning for the Go Out program[25] as well as the major plans that derive from it, including the Strategic Emerging Industries Initiative and Made in China 2025.[26] Two Markets, Two Resources spells out an approach to globalization, and integration, that rests on claiming the world’s independence without surrendering China’s own.[27] Beijing is to build integrated, complete, relatively isolated supply chains while securing influence over foreign ones[28] and to ensure relatively complete supply over necessary resources while claiming influence over their price and supply on the international market.[29]

Such asymmetric influence may help Beijing to secure access to foreign technological resources: Foreign dependence also grants Beijing the potential for coercive leverage.

The Role of Military-Civil Fusion

This asymmetric Chinese science and technology strategy services military ends – and those of coercive power projection more generally. This is both reflected and operationalized in China’s strategy of military-civil fusion.” If we do something different, we will be able to catch up, concentrate our efforts, and achieve breakthroughs,” wrote Zhu Heping,dean at Jiangnan University, in his 2005 doctoral dissertation. Zhu focused on the theory, direction, and modes of a newly official “innovation” in Hu Jintao’s national development and military strategy: “military-civilian fusion with Chinese characteristics” (MCF) (中国特色军民融合). MCF marked a great “historical change.” It inherited from the long-standing, holistic Chinese vision of “military civilian combination” (军民结合).[30] The strategy would leverage the particularities of the unified, large-scale Chinese system asymmetrically to seize opportunities presented by emerging technologies and a globalized geopolitical landscape. It would consolidate both economic and military resources in support of fused economic and military goals. And it would do so by manipulating the open exchanges between the PRC civilian sector and the rest of the world.

A “grand strategy” [31] rather than an input or a process, MCF entails a constant “dual flow of resources”[32] among military and civilian. They do not just mutually reinforce. They exist in constant, fluid exchange. And both are deployed to the same ends: Civilian actors are marshalled to play a national security role; military actors to help develop or serve the civilian sector. In MCC, military enterprises were encouraged to produce both civilian and military goods. In MCF, both civilian and military enterprises produce resources for both the civilian and the military enterprises. Those resources are used both for economic development and national defense. Moreover, the positioning of civilian or commercial players can be used to project power, coercive, or otherwise support the PRC’s national strategy. The defense S&T industry is considered part and parcel of the broader S&T industry.[33] Military and civilian are different only in name. As one scholar puts it, “the military is for civilian use, the civilian is military, and the military and civilian are fused.”[34]

Qiaohai Shu of the China Academy of Social Sciences explained the reasoning in a 2011 article: “Innovation is time-consuming, laborious, and risky…But when it comes to applying technology, the opportunity cost to leap ahead is low, the chances of success high.”[35]

Policy Recommendations: Targeting the Core

China’s technology acquisition and military-civil fusion efforts function under the guise of a State led, Enterprise driven approach to economic competition. Understanding the reality of how that system is animated through industrial policy reveals its relative strengths in today’s strategic context; understanding the Chinese industrial policy system also generates heuristics for competing more effectively against Beijing’s tack. In short, US policy needs better to target the core – the central, coordinating and resourcing nodes — of China’s approach to accruing value chain leverage in key technology areas.[36]

US policy needs urgently to update for the dynamic – yet relatively centralized – target set China’s strategy provides. The playbook of Cold War containment and War on Terror precision economic warfare is ill-suited for the shrewd, and scaled, positioning and influence that China holds in today’s capital and technology markets.

This means that existing defensive tools, like foreign investment screening and technology export controls, need to be revamped with broader capacity to target China’s core technology champions – and the negative externalities their technology acquisition efforts generate.

That effort will require enhanced monitoring of China’s corporate, industrial, and S&T ecosystem. It will also require re-wiring and energizing organizational lines of communication and authorities across inter-agency processes to orient around the pacing threat that China poses today.

Export Restriction Revisions

Export restriction authorities offer a prime and salient example of the need to re-orient existing tools for today’s competitive environment and threat. China’s technology acquisition playbook and military-civil fusion strategy render ineffective entity-based efforts to restrict technology. The US export control approach needs to shift in a broad-based fashion toward sector-based designations of restriction. That will require a thorough, transparent, and broadly accepted definition of emerging and foundational technology. That definition should be grounded in the PRC’s own definitions and indicators of observable preference assigned to technology areas by China’s industrial policy and military-civil fusion ecosystems.

US export controls have been expanded drastically over the past few years in key sectors, like telecommunications and integrated circuits. But even accepting success in certain instances – like against Huawei and ZTE – it is clear that those efforts amount to a game of whack-a-mole. And Beijing is deft at leveraging the international private sector’s short-term orientation to complicate US export control targeting and implementation. China’s approach to gaining leverage in the global semiconductor value chain and developing redundancy in access points to cutting-edge Western technology is a timely example. Even Huawei, perhaps the company targeted most aggressively by US action to date, has continued to thrive in next-generation domains. Huawei’s corporate venture arm and HiSilicon subsidiary have recently taken significant positions in and gained access to key technologies for compound semiconductors, including germanium and indium phosphide compositions with important dual-use applications.[37]

Companies like ChangXin Memory Technologies (CXMT) demonstrate how lesser-known nodes in China’s vast semiconductor ecosystem can further evade targeted treatment and prevent the imposition of a robust technology blockade. CXMT’s origin story is straight out of China’s industrial policy playbook: In 2016, China’s Hefei Province launched the “506 Project,” a high-profile but cryptic technology development effort. It leveraged some 54 billion RMB of provincial funds, backed by the Chinese central government’s integrated circuit investment fund, and the expertise of leadership from SMIC, one of China’s top state-owned semiconductor companies, which was placed on the Department of Commerce’s Entity List in 2020. The 506 Project’s goal was simple: To develop a Chinese domestic state champion in DRAM, or dynamic random access memory. In 2018, the 506 Project became CXMT, a part of the “Made in China 2025” national strategy and China’s Science and Technology National Key Projects. In 2019, CXMT started mass production. Today, the company is closely integrated into China’s military and surveillance systems; supplies and partners with a “Who’s Who” of Chinese military and government players including DJI, Hikvision, China Telecom, and Huawei; and co-invests with Chinese government and military players. “CXMT has fired a resounding shot,” reported Chinese media in 2022, “in the chokehold counterattack.”

US export restrictions have targeted a host of Chinese bad actors, like SMIC. Those efforts, while commendable, have had limited effect on SMIC’s operations and dominance of legacy integrated circuit market segments.[38] And lesser-known entities, like CXMT and an entire ecosystem of similar actors, continue to operate even more freely. As long as US export restrictions and other measures take an entity-focused approach, targeting individual players, China will maintain a new cast of related technology leaders, poised to swoop in and serve targeted players’ roles. This type of redundancy is no anomaly; other bad actors like CXMT in the Chinese semiconductor ecosystem continue to fly below the radar of US defensive policies – and this reality is inherent in how Beijing layers its S&T ecosystem more generally, beyond semiconductors. This is no accident: Chinese industrial policy assesses and abuses weaknesses in the US export restriction system to guarantee access – even if through circuitous routes and not by legacy champions. That means that entity-based processes risk continuing to be a step behind in their ad hoc targeting of actors of concern.

Targeting the core of China’s emerging and foundational technology approach will require understanding China’s own definitions – and mustering the political will to adopt sector-wide restrictions.

Investment Screening Updates

Foreign investment screening – as executed in the United States under the CFIUS process – also needs urgent updating. Outbound investment screening is one key pillar for such updating: Capital directed by US persons and entities should be restricted from supporting China’s development of emerging technology relevant to human rights abuses and to military modernization. Efforts to address capital flowing into critical sectors in China like semiconductors, quantum, artificial intelligence, and biotechnology seem worthwhile to be pursued and enforced. And here, too, related efforts should leverage China’s own definition of critical sectors – and a sector-based approach to covered transactions – lest US defenses be scattered and piecemeal in the face of a deliberate Chinese approach.

A useful guide – and set of targets – for the Chinese prioritization of S&T investments can be found in the array of government guidance funds backed by the Chinese state to invest into emerging and foundational technologies. It is not enough, however, to block US capital from entering sensitive domains in China or to restrict the operations of government-linked investment vehicles in China. Beijing also indirectly accesses critical technology, infrastructure, and data in the United States via LP relationships in US funds.[39] Take, for example, the Shanghai Yangpu Government Guidance Fund. That fund invests as a limited partner in venture funds managed by Walden International, which itself is a prominent example of a venture investor with a presence in the United States and an explicit focus on cross-border US-China investment. Qiming Ventures and its US-based office operating under the name Qiming Venture Partners (USA) offer another example. Qiming has raised at least seven different US dollar-denominated funds and five RMB-denominated funds since 2006. Its backers have included the National Development and Reform Commission, China Development Bank, and other Chinese insurance firms, asset managers, and funds of funds. Qiming even nests into the Chinese industrial policy ecosystem as a fund manager of industry park-specific investment vehicles – for example, Qiming at one point managed and may still manage the Suzhou Industry Park family of funds.

These bilateral nodes should be required to disclose information about their sources of funds and their direct ties to technology development efforts in China. The flow of capital from China to US-domiciled funds in the form of LP stakes should be eligible to be reviewed by CFIUS for national security risks that arise from the informational rights that LPs are afforded in funds that invest into critical technology, infrastructure, and data. A further strategic solve for investment screening would be to move from transactional reviews to a rebuttable presumption about inbound flows of capital from China: Funds and operating companies that wish to raise funds from CCP-linked sources should be presumed to be at risk unless they can verify that the CCP-linked funds do not support China’s pursuit of military modernization or military-civil fusion more generally.

Capital Markets Transparency

Global capital markets support the PRC’s economic model and its support for technology acquisition. The result: The PRC’s tech and military-civil fusion strategies operate at a profit. This is perhaps the starkest contrast with the Soviet example of the Cold War.

At a strategic level, China’s integration with global capital markets shapes Beijing’s cost of empire, a potentially critical factor in today’s great power competition: The Soviet Union’s closed system created sunk costs and economic burdens that ultimately weighed on the ruling regime’s efficacy and survival. By contrast, capital integration – and the willingness of a US-led global capital market to underwrite the economic model refined by the CCP – may allow Beijing to enjoy modes of power projection and influence with a cost profile drastically different from other historical examples. If China can use cutting-edge technology to perfect and automate elements of its military modernization agenda or surveillance state operations, Beijing’s overall cost structure will benefit from an economy of scale. If China can obtain such cutting-edge technology at least in part through integration into global private and public capital markets, it could, in fact, turn a profit in the process.[40]

There have been signals of potential upheaval in China’s treatment by Western capital markets over the past five years. Tussles over accounting standards and the risk of de-listing threatened against “Communist Chinese Military Companies” have impacted the volume of funds flowing on American exchanges to publicly listed Chinese champions. The 2022 de-listing in the United States of Didi, the Chinese ride-hailing unicorn, served as a stern warning of a potential freeze in high profile capital flows.

But those signals have tended to exist only on the surface level and in the short term. This is well reflected in the thawing of the post-Didi potential freeze in high profile capital flows; the February 2023 initial public offering of Hesai Group in New York. Hesai is a critical technology player. It is a Chinese lidar manufacturer that serves the growing market of autonomous vehicles – and that is enmeshed in the Chinese MCF ecosystem. Hesai’s February IPO went off without a hitch. That moment has been covered positively in both Chinese and English financial press as a harbinger of positive momentum for Chinese listings in the United States in the year ahead.[41]

This positive sentiment from the marketplace runs contrary to the split screen with the policy world’s “de-risking” rhetoric: For example, the US House of Representatives Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party held its initial public hearing in February 2023 bearing the title “The Chinese Communist Party’s Threat to America.” All the while, Goldman Sachs and Morgan Stanley were hard at work in the empirical reality of underwriting the vehicle for US capital markets to remain wedded to Beijing’s tech champions — in this case, Hesai Group

Emerging technology – like the lidar systems propelling advances in autonomy – should, if anything, be more susceptible to sensitivities of “de-risking.” This sensitivity isn’t lost on the Chinese company in question: Hesai’s IPO prospectus is the only document in the SEC’s EDGAR database to reference the risk posed to the company by the Chinese government’s “counter foreign sanctions” regime. In other words, Hesai is keenly aware of the Chinese government’s points of leverage over it. Yet the company is free to decrease its cost of capital and increase its market value by linking up with American capital markets.

A set of necessary policy updates in this realm would start at the point of information availability and transparency. The SEC in the United States should require Chinese-domiciled entities to provide detailed accounting for their ties to the Chinese State and to the Chinese military and surveillance apparatus as a part of fundraising efforts in the United States.

Conclusion: Activating Enduring Strengths

It is necessary – but insufficient – to update American defensive tools better to target the core of China’s emerging technology apparatus. Additional lines of effort need to be resourced and executed to align defensive tools with proactive investments; to catalyze the US private sector and the power and pressure of US capital markets; and, to activate the same equities and pressures in allied and partner markets.

These lines of effort – cutting across offensive and defensive tools for emerging technology competition – need to be realistic and fully informed about China’s approach. Beijing’s tack in emerging technology competition today is consistent with what it has been for the past generation: China sits downstream of innovation and benefits from the high-risk, high-cost investments of the open, global research community.

Monitoring of this strategic approach in practice should focus in on the industrial and S&T policy means that propel China’s industrial offensive. That effort will require increased resourcing of intelligence efforts and increased information sharing channels across inter-agency equities in government. Even more critical, though, will be how those information sharing efforts can be activated to inform global capital markets and US allies and partners.

China’s global operating presence, asymmetric integration in technology and capital ecosystems, and military-civil fusion strategy can only be overcome by a US strategy that activates non-governmental and allied non-governmental equities to compete.

[1] As with all official PRC government statistics, the exact absolute figures reflected must be taken with a grain of salt. But the fundamental trendlines and ratios may be telling. Definitional issues with Chinese data present challenges for comparative analysis. Direct comparison to US government R&D expenditures is complicated by CCP definitions; the convention definition of “basic” or “applied” research is not reflected in Chinese government statistics. US federal R&D in 2018 dedicated to basic and applied accounted for slightly over half of spending with the “developmental” stage of funding accounting for 47 percent; see, Congressional Research Service, U.S. Research and Development Funding and Performance: Fact Sheet, January 2020.

[2] Winners receive a cash prize. They receive more than the equivalent in reputational advance: MOST’s national-level prizes define success in the Chinese S&T ecosystem. They shape not just individual researchers’ status, but also that of the institutions to which they belong. These are not about messaging. They are about Chinese priorities, perceptions, and progress (国家科学技术奖励工作办公室 [National Science and Technology Award Office].)

[3] See, for example, James Manyika, William McRaven, and Adam Segal, “Keeping Our Edge: Innovation and National Security Force Report,” Council on Foreign Relations, September 2019.

[4] For an example of the depth of integration in even military-relevant market segments, see Stuart Lau, “EU champion Airbus has deep links to Chinese military industrial complex, report says,” Politico, June 22, 2022, https://www.politico.eu/article/eu-champion-airbus-has-deep-links-to-chinese-military-industrial-complex-report-says/.

[5] Emily de La Bruyère and Nathan Picarsic, Military-Civil Fusion: China’s Approach to R&D, Implications for Peacetime Competition, and Crafting a US Strategy, 2019 USN/NPS Acquisition Research Symposium, May 2019. Accessible at www.targetingthecore.com/militarycivilfusion.

[6] For a detailed analysis of China’s industrial policy system, see Little Giants, Single Champions: China’s Blueprint for Asymmetric Industrial Advantage, March 2023, https://forcedistancetimes.com/little-giants-single-champions-report/; as profiled in Karen Hao, “China Cultivates Thousands of ‘Little Giants’ in Aerospace, Telecom to Outdo U.S.,” The Wall Street Journal, March 16, 2023, https://www.wsj.com/articles/china-cultivates-thousands-of-little-giants-in-aerospace-telecom-to-outdo-u-s-97ef9bdb.

[7] Nathan Picarsic and Emily de La Bruyère, “China, coronavirus & threat of integration,” Tribune Review, March 8, 2020, https://triblive.com/opinion/nathan-picarsic-emily-de-la-bruyere-china-coronavirus-threat-of-integration/.

[8] The authors would like to recognize countless contributions in terms of research support, feedback, and guidance on this testimony and related topics from colleagues including Rob Bair, Aidan Campbell, Stephen Cambone, Clint Cox, Genevieve Cox, Joe Dyer, Jeff Fiedler, Chris Griffin, Alexandra Hartman, Mark Montgomery, Mary Lee Murray, Amelia Shapiro, Michael Wessel, Larry Wortzel, and Worth Wray.

[9] Emily de La Bruyère and Nathan Picarsic, “Defusing Military-Civil Fusion,” Foundation for Defense of Democracies, May 2021, https://www.fdd.org/analysis/2021/05/26/defusing-military-civil-fusion/.

[10] MOST, National Science and Technology Prizes, 2000-2019.

[11] According to the National Congress of the Communist Party, the office’s purpose was better to integrate the ‘introduction’ [of technology] and the ‘going out’ [of companies] by supporting enterprises’ international operations in research and development, production, and sales.” (侯强 [Hou Qiang]. 新中国70年高新技术产业国际合作政策制定的逻辑基点及其经验 [The logical basis and experience of 70 years of new China ’s high-tech industrial cooperation], 青海社会科学 [Qinghai Social Sciences], June 2019.)

[12] 侯强 [Hou Qiang]. 新中国70年高新技术产业国际合作政策制定的逻辑基点及其经验 [The logical basis and experience of 70 years of new China ’s high-tech industrial cooperation], 青海社会科学 [Qinghai Social Sciences], June 2019.

[13] Ibid.

[14] Ibid.

[15] [乔海曙] Qiaohai Shu. 物联网产业突破发展研究 [Internet of Things Industry Breakthrough Research], 经济问题探索[Exploring Economic Issues], 2011.

[16] 侯强 [Hou Qiang]. (2019). 新中国70年高新技术产业国际合作政策制定的逻辑基点及其经验 [The logical basis and experience of 70 years of new China ’s high-tech industrial cooperation]. 青海社会科学 [Qinghai Social Sciences].

[17] See, for example, 杨丹辉 [Yang Danhui]. 资源安全、大国竞争与稀有矿产资源开发利用的国家战略 [National strategy for resource safety, competition among major powers, and development and utilization of rare mineral resources]. 学习与探索 [Study and Exploration]. 2018.

[18] See, for example, retired PLA commander Wang Xiangsui’s discussion of a “subversive, coercive deterrent” in Wang Xiangsui [王湘穗]. China’s Role in the Future World [未来世界的中国地位]. Beijing: Changjiang New Century Culture Media Company, 2017.

[19] 陈金明 [Chen Jinming], 汪平 [Wang Ping]. 借鉴国际经验 完善我国企业“走出去”政策. [Drawing lessons from international experience, perfecting the “going out” policy of Chinese enterprises]. 全球化 [Globalization], 2013.

[20] 胡振虎 [Hu Zhenhu] 于晓 [Yu Xiao]. 特朗普政府加大中企赴美投资审查力度:原因、趋势与对策 [The Trump administration intensifies the review of Chinese companies ’investment in the United States: causes, trends and countermeasures]. 财政科学 [Fiscal Science], 2018.

[21] 王军 [Wang Jun]. 对美国债变投资是双赢之举 [Investing in the U.S. debt to change is a win-win move]. 中国金融 [China Finance], 2011.

[22] See, for example, discussion of investment as a mechanism as reflected over time in 雷光宇 [Lei Guangyu]. 金融危机背景下中国应对美国贸易保护主义的对策 [China’s countermeasures against US trade protectionism in the context of financial crisis]. 中国商贸 [China Business], 2012; 曹晓蕾 [Cao Xiaolei]. 基于脱钩视角的中美经贸关系研究 [Research on Sino-US Economic and Trade Relations from the Perspective of Decoupling], 世界经济与政治论坛 [World Economic and Political Forum], 2013; 胡振虎 [Hu Zhenhu] 于晓 [Yu Xiao]. 特朗普政府加大中企赴美投资审查力度:原因、趋势与对策 [The Trump administration intensifies the review of Chinese companies ’investment in the United States: causes, trends and countermeasures]. 财政科学 [Fiscal Science], 2018.

[23] Yu Xinyan [余 鑫 炎]. On Opening up Two Markets Within and Outside the Country [论开拓 国内国外两个市场]. Journal of Hubei University of Finance and Economics, 1985. See related discussion in Emily de La Bruyère and Nathan Picarsic, “The price of dependency: The rhetoric and reality of de-risking US-China ties,” Hinrich Foundation, June 2023, https://www.hinrichfoundation.com/research/wp/us-china/the-price-of-dependency-the-rhetoric-and-reality-of-de-risking-us-china-ties/.

[24] National People’s Congress, Resolutions of the Fourth Session of the Fifth National People’s Congress on the Report on “Current Economic Situation and Guidelines for Future Economic Construction” (第五届全国人民代表大会第四次会议关于 “当前的经济形势和今后经济建设的方针” 报告的决议), December 13, 1981.

[25] Shen Chuanliang, Historical Evolution of China’s Opening Strategy (中国对外开放战略的历史演), Journal of Liaoning Normal University, 2014.

[26] State Council, Guiding Opinions on Promoting the International Development of Strategic Emerging Industries (关于促进战略性新兴产业国际化发展的指导意见), October 25, 2011; State Council of the People’s Republic of China, Made in China 2025 (国务院关于印发《中国制造2025》的通知), May 8, 2015. Translation.

[27] National People’s Congress, “Resolutions of the Fourth Session of the Fifth National People’s Congress on the Report on ‘Current Economic Situation and Guidelines for Future Economic Construction’” (第五届全国人民代表大会第四次会议关于 “当前的经济形势和今后经济建设的方针” 报告的决议), December 13, 1981.

[28] See, for example, discussion of complete industrial chains in the State Council’s 2010 Decision on Accelerating the Cultivation and Development of Strategic Emerging Industries.

[29] Two Markets, Two Resources is spelled out neatly in Ni Hongxing. Integrate Two Markets and Two Resource to Ensure the Safety of the Agricultural Industry (统筹两个市场两种资源 确保农业产业安全), China Rural Economy, May 30, 2011.

[30] Zhu Heping [朱和平]. “National Security and National Defense Economic Development” [国家安全与国防经济发展], Huazhong Normal University, 2005.

[31] Zhou Xiaoping [周孝平]. “Research on the Harmonious Development of National Defense Construction and Economic Construction” [国防建设与经济建设协调发展研究]. National University of Defense Technology, 2006.

[32] Wu Xixin [武希心], Huang Jing [黄靖]. Defense Economics [国防经济学]. Beijing: Military Sciences Press [军事科学出版社], 2013.

[33] The Academy of Military Science lays out an additional series of key distinctions. First, MCF is designed for the “socialist market economy” rather than the “socialist planned economy;” optimized to accord with the PRC equivalent of market forces and therefore to interact with global market structures. Where MCC was driven entirely by administrative government promotion, MCF takes advantage of dynamic market mechanisms. MCF also deploys a broader set of tools. Where MCC looked narrowly at the “national defense science and technology industry,” MCF includes the entire national science and technology industry – as well as equipment, education, talent, military support, and mobilization. Finally, is the question of ends. MCC under Deng focused on using “surplus national defense resources to produce civilian goods.” MCF seeks to leverage civilian and military resources for “national defense” writ large. (Zhou Xiaoping [周孝平]. “Research on the Harmonious Development of National Defense Construction and Economic Construction” [国防建设与经济建设协调发展研究]. National University of Defense Technology, 2006.)

[34] Ma Qing Feng [马青锋]. “Research on the Synergy Between Defense Economy and National Economy” [中国国防经济与国民经济同共促研究]. Henan University, 2013.

[35] Qiaohai Shu [乔海曙]. “Internet of Things Industry Breakthrough Research”[物联网产业突破发展研究].Exploring Economic Issues [经济问题探索], 2011.

[36] See www.targetingthecore.com for a new series of research products published by Horizon Advisory monitoring technology access and corporate performance of key nodes in China’s industrial ecosystem, including across the semiconductor value chain.

[37] Mary Hui, “Indium phosphide could be critical to China’s semiconductor ambitions,” Force Distance Times, July 26, 2023, https://forcedistancetimes.com/china-indium-phosphide-semiconductors-critical-minerals.

[38] Arjun Kharpal, “China’s biggest chipmaker SMIC posts record 2022 revenue but warns of a tough year ahead,” CNBC, February 10, 2023, https://www.cnbc.com/2023/02/10/chinas-biggest-chipmaker-smic-posts-record-2022-revenue.html.

[39] Emily de La Bruyère and Nathan Picarsic, The Weaponization of Capital: The Strategic Implications of China’s Private Equity and Venture Capital Playbook, Foundation for Defense of Democracies, September 2022, https://www.fdd.org/analysis/2022/09/15/the-weaponization-of-capital-chinas-private-equity-venture-capital/; Heather Somerville, “Chinese Investment Flows to Silicon Valley Venture Funds,” Wall Street Journal, September 15, 2022, https://www.wsj.com/articles/chinese-investment-flows-to-silicon-valley-venture-funds-11663234202.

[40] For a more thorough discussion of these factors and their national security implications, see Nathan Picarsic, “Testimony before the US-China Economic and Security Review Commission: US Investment in China’s Capital Markets and Military-Industrial Complex,” March 19, 2021, https://www.uscc.gov/sites/default/files/2021-03/Nate_Picarsic__Testimony.pdf.

[41] See, for example, Scott Murdoch and Echo Wang, “Hesai Group Rises in US IPO, Biggest for Chinese Firm Since 2021,” Reuters, February 10, 2023, https://www.reuters.com/technology/hesai-group-rises-us-ipo-biggest-chinese-firm-since-2021-2023-02-10/.