March 24, 2022 | Policy Brief

Tehran to Pocket Billions From Lower Import Costs if Sanctions Are Lifted

March 24, 2022 | Policy Brief

Tehran to Pocket Billions From Lower Import Costs if Sanctions Are Lifted

Washington and Tehran may soon strike an agreement to revive the 2015 nuclear deal, formally known as the Joint Comprehensive Plan of Action (JCPOA). In exchange for temporary nuclear concessions, the United States will lift sanctions against Iran, providing the Islamic Republic with significant economic benefits, including cheaper imports.

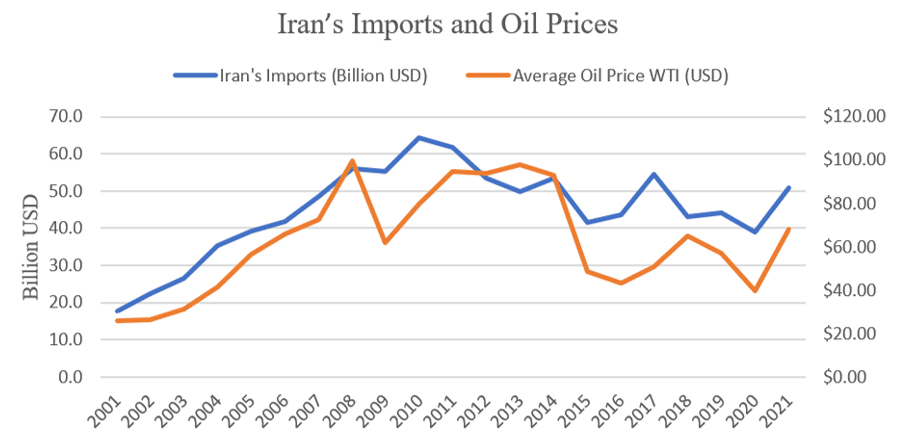

Western sanctions, along with oil price cycles, have driven fluctuations in Iranian imports over the last decade. Iran’s imports rose consistently from 2001 until 2011, when the Iranian economy came under significant pressure from international sanctions, contributing to a steep decline in Iranian imports. The interim nuclear agreement struck in late 2013 temporarily suspended some sanctions, leading to a small rise in Iranian imports. The JCPOA, which was negotiated in 2015 but took effect in January 2016, caused Iran’s imports to increase slightly that year despite low oil prices. Iranian imports then peaked in 2017 as the oil price increased.

In 2018, the Trump administration exited the nuclear deal and re-imposed sanctions on the Islamic Republic. Iran’s imports declined by 21 percent despite a 28 percent increase in the price of oil. In 2020, U.S. sanctions and the global recession triggered by the COVID-19 pandemic pushed Iranian imports down to their lowest nominal level since 2004. They bounced back the following year amid loose sanctions enforcement by the Biden administration, the global economic recovery, and rising inflation.

Sanctions not only deprive the Islamic Republic of revenue with which to purchase imports, but also make those imports more expensive. This derives primarily from the increased transaction costs and perceived risk of doing business with Iran, and from the smaller pool of business counterparties willing to work with Iran.

In April 2021, Mohammad Shariatmadari, the regime’s labor minister, said sanctions had increased the cost of imports by 20 percent. Assuming that figure held constant for the Persian calendar year 1400 (April 2021 to March 2022), during which time the Islamic Republic imported an estimated $50.8 billion worth of goods and services, then sanctions cost the regime almost $10 billion that year. Assessments of the increased cost by other Iranian officials and media sources have varied widely, between 8 to 30 percent.

If Washington lifts sanctions, the regime will benefit greatly in the short and long term. Iranian imports during the next Persian calendar year (April 2022 to March 2023) will likely total around $60 billion if U.S. sanctions are lifted. Using Shariatmadari’s 20 percent figure, the lower cost of imports would save the Islamic Republic $12 billion. That is in addition to the almost $131 billion in foreign assets to which Iran will gain access following U.S. sanctions relief, not to mention tens of billions of dollars in additional export revenue.

These funds will help Tehran mitigate domestic discontent, solidify geopolitical gains across the Middle East, and open new battle fronts in its quest to dominate the region. None of this would serve U.S. national interests.

Saeed Ghasseminejad is a senior advisor on Iran and financial economics at the Foundation for Defense of Democracies (FDD), where he contributes to FDD’s Iran Program and Center on Economic and Financial Power (CEFP). For more analysis from Saeed, the Iran Program, and CEFP, please subscribe HERE. Follow Saeed on Twitter @SGhasseminejad. Follow FDD on Twitter @FDD and @FDD_Iran and @FDD_CEFP. FDD is a Washington, DC-based, non-partisan research institute focused on national security and foreign policy.