March 9, 2022 | Policy Brief

The New Nuclear Deal Would Allow Tehran to Access Up to $131 Billion of Its Foreign Assets

March 9, 2022 | Policy Brief

The New Nuclear Deal Would Allow Tehran to Access Up to $131 Billion of Its Foreign Assets

The Biden administration is finalizing a deal that would provide the Islamic Republic with relief from U.S. sanctions in exchange for temporary and limited curbs on Iran’s nuclear program. When the administration lifts sanctions, Tehran will immediately gain access to an estimated $86.1 billion to $130.5 billion in foreign assets that currently are not fully accessible and readily available.

When the Trump administration quit the Iran nuclear deal in May 2018, it forced the SWIFT global financial messaging service to disconnect Iranian banks and imposed sanctions on Iran’s central bank and financial sector. These actions limited Iran’s access to the global financial system and to its foreign currency reserves and export revenue, much of which remain trapped in foreign bank accounts. Lifting sanctions would allow Iran to regain access to these funds.

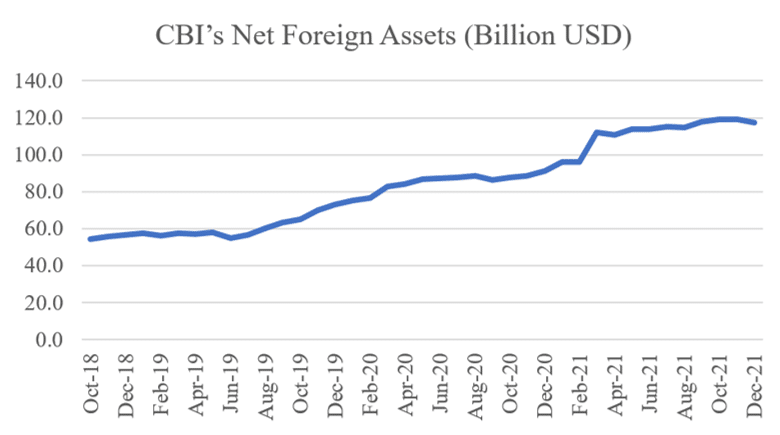

The Central Bank of Iran (CBI) publishes data on its own foreign assets and on those held by all other financial institutions in the country. One should take these numbers with a grain of salt, as verifying their veracity is difficult due to the lack of transparency and alternative sources of information. The CBI reported having $117 billion in net foreign assets as of December 2021, while the Iranian financial system — that is, the CBI plus all other financial institutions — had $166 billion.

Table 1: Iran’s Foreign Assets as of December 2021 (Billion USD)

| Gross Foreign Assets | Foreign Liabilities | Net Foreign Assets | |

| Central Bank | 161.9 | 44.4 | 117.5 |

| Financial System | 493.1 | 326.9 | 166.2 |

Source: CBI

The graph above shows that the CBI’s net foreign assets grew following the re-imposition of U.S. sanctions. This is the result of several factors. First, U.S. financial sanctions generally take immediate effect, and major financial institutions around the world heed them assiduously, so Tehran lost access to much of its foreign assets rather quickly. Second, Iran’s neighbors and China have not been keen on enforcing trade sanctions against the Islamic Republic, so Iran continued to accumulate export revenue in foreign accounts it could not fully access. Third, to help weather U.S. sanctions, Tehran decided to limit its imports and outflow of capital, so it spent less of its foreign currency than it otherwise would have.

Analysts disagree over exactly how much of Iran’s foreign assets are fully accessible to the regime. In its latest regional report in October 2021, the IMF estimated Iran’s readily available and controlled external assets to be $31.4 billion. Subtracting that figure from the $161.9 billion in gross foreign assets the CBI reported having as of December, one can estimate that sanctions relief will grant Tehran access to an additional $130.5 billion in gross foreign assets.

Depending on the terms of the CBI’s $44.4 billion in foreign liabilities, some of those assets may be needed to retire liabilities. However, the remaining $86.1 billion are not tied to any foreign liability. In other words, the CBI will gain access to at least $86.1 billion and potentially as much as $130.5 billion in foreign assets.

The regime’s track record suggests it will use some of these newly liberated resources to pacify domestic discontent by rewarding loyalists and curbing inflation. But Tehran likely will also invest a significant portion in its military, particularly the Islamic Revolutionary Guard Corps. In addition, the regime will likely double down on its support for its terrorist proxies across the region, such as Hezbollah in Lebanon, the Houthis in Yemen, and various militant groups in Iraq.

Like the 2015 nuclear deal with Iran, the Biden administration’s new Iran deal includes no measures to prevent Tehran from supporting terrorism or other forms of aggression, while at the same time providing the regime with increased resources to fund those activities.

Saeed Ghasseminejad is a senior advisor on Iran and financial economics at the Foundation for Defense of Democracies (FDD), where he contributes to FDD’s Iran Program and Center on Economic and Financial Power (CEFP). For more analysis from Saeed, the Iran Program, and CEFP, please subscribe HERE. Follow Saeed on Twitter @SGhasseminejad. Follow FDD on Twitter @FDD and @FDD_Iran and @FDD_CEFP. FDD is a Washington, DC-based, non-partisan research institute focused on national security and foreign policy.