May 6, 2020 | Policy Brief

The Impact of Sanctions Two Years After U.S. Withdrawal From the Nuclear Deal

May 6, 2020 | Policy Brief

The Impact of Sanctions Two Years After U.S. Withdrawal From the Nuclear Deal

Two years into President Donald Trump’s maximum pressure campaign against the Islamic Republic of Iran, U.S. sanctions – when enforced – have pushed Iran into a deep, multi-year recession, slashed the value of its currency, ratcheted up inflation, driven out foreign investors, and deprived the regime of tens of billions of dollars in revenue, especially from oil exports. This economic pressure is already translating into political pressure, which may force the regime to decide between its survival, on the one hand, and its nuclear ambitions and foreign wars on the other.

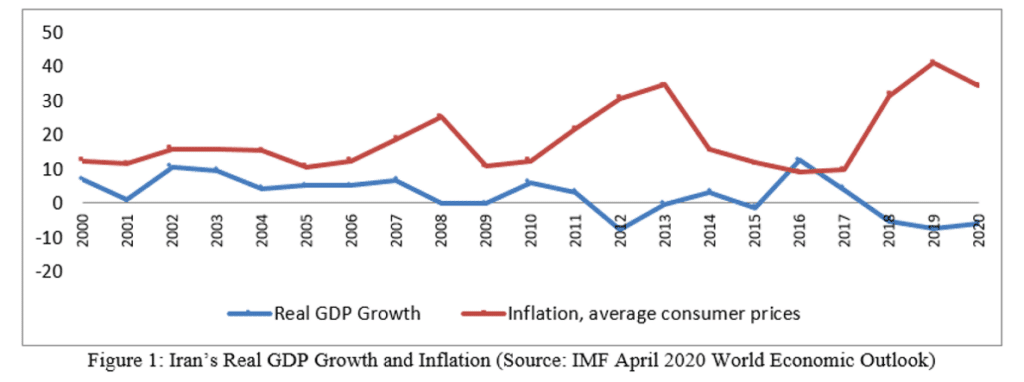

Iranian GDP surged by 12.5 percent in 2016, the first year that the Joint Comprehensive Plan of Action (JCPOA) was in effect, and enjoyed solid growth of 3.7 percent in the deal’s second year. A sharp reversal followed the U.S. withdrawal from the JCPOA, with negative growth of 5.4 percent in 2018 and 7.6 percent in 2019. The economic impact of the COVID-19 pandemic has led the International Monetary Fund (IMF) to forecast a further drop of 6 percent in 2020.

Inflation followed a similar pattern of substantial improvement while the nuclear deal was in effect, followed by a dramatic reversal after the onset of maximum pressure. After falling below 10 percent in 2016 and 2017, the inflation rate shot up to 31.2 and 41.4 percent in 2018 and 2019, respectively. The IMF forecasts an inflation rate of 34.7 percent in 2020.

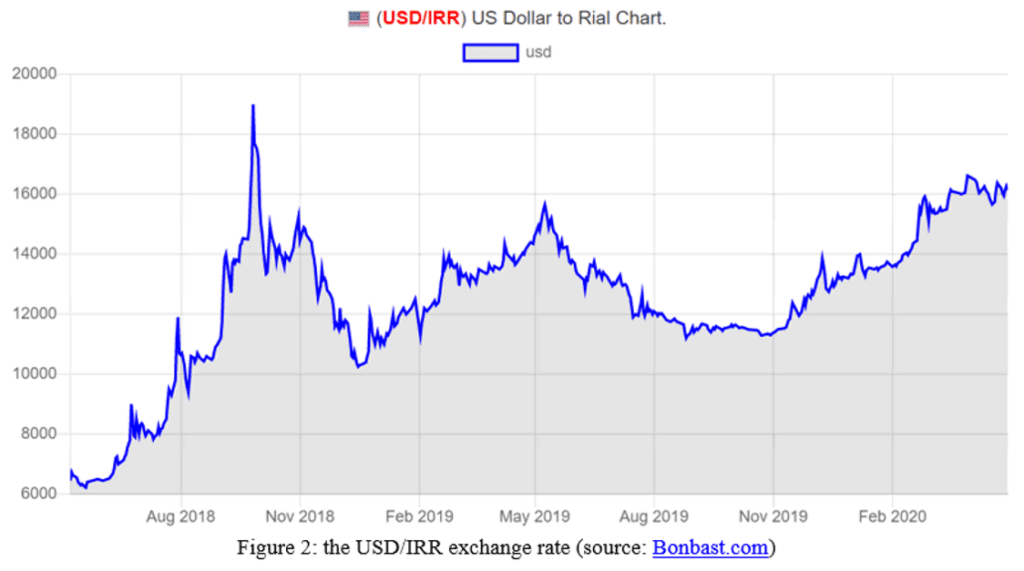

Maximum pressure has also battered Iran’s currency, which was trading at 64,500 rial to the dollar on May 7, 2018 (the day before the U.S. withdrawal from the JCPOA) but has since fallen to 163,000 rial as of May 6, 2020, a 60 percent depreciation. Iran’s liquid reserves are also drying up quickly, which could lead to further depreciation of the rial.

The cause of the greatest damage to the Iranian regime’s finances was Trump’s decision to end all exceptions to sanctions on Iranian oil. China is now the only paying customer for Iranian crude, yet its purchases have fallen 83 percent over the last year. The United States has imposed sanctions on some Chinese importers, while Beijing’s state-owned enterprises have kept their distance.

The loss of oil revenue has had direct fiscal and political consequences for Iran. Facing a massive budget deficit, the regime raised the price of gasoline sharply last November, resulting in nationwide protests. The regime proceeded to massacre peaceful demonstrators, who blamed their own rulers, not the United States, for the country’s deprivation.

The next target for the maximum pressure campaign should be Iran’s revenue from non-oil exports, such as petrochemicals and industrial metals. While sanctions on these goods are already in place, enforcement has not been sufficient to substantially drive down exports. Iran’s roughly $40 billion in annual revenue from non-oil exports is protecting the regime from both budget and balance-of-payments crises.

Three-quarters of Iran’s non-oil exports go to China, Turkey, Iraq, the United Arab Emirates, and Afghanistan. The United States has ample leverage over the latter three countries. A sustained crackdown would also confront Turkey and China with risks they can ill afford.

While its own malpractice is responsible for the terrible impact of the novel coronavirus, the regime is exploiting the crisis to advocate for sanctions relief on humanitarian grounds. The regime has more than sufficient reserves to deal with the pandemic, and its claims that sanctions prevent key medical imports are deeply misleading.

With the plunge in oil prices, now is the time to accelerate Iran’s cash crunch via full enforcement of U.S. sanctions, especially on the non-oil sectors of Iran’s economy. There should be no relief until the regime makes credible and verifiable commitments to end its nuclear program, foreign aggression, terrorism, and grave human rights violations.

Saeed Ghasseminejad is a senior Iran and financial economics advisor at the Foundation for Defense of Democracies (FDD), where Richard Goldberg is also a senior advisor. They both contribute to FDD’s Center on Economic and Financial Power (CEFP). For more analysis from Saeed, Richard, and CEFP, please subscribe HERE. Follow Saeed and Richard on Twitter @SGhasseminejad and @rich_goldberg. Follow FDD on Twitter @FDD and @FDD_CEFP. FDD is a Washington, DC-based, nonpartisan research institute focusing on national security and foreign policy.