April 7, 2020 | Policy Brief

COVID-19 in the Gulf

April 7, 2020 | Policy Brief

COVID-19 in the Gulf

The coronavirus pandemic and Russian-Saudi oil price war have triggered an historic drop in oil prices, shaking the economic and fiscal foundations of the oil-dependent Arab Gulf states and stretching their capacity to respond to the ongoing economic and public health crisis. Heading into a Thursday meeting of major oil producers, the Arab Gulf states desperately need an agreement to cut oil production and boost prices, but the prospects for such a deal remain uncertain.

Situation Overview

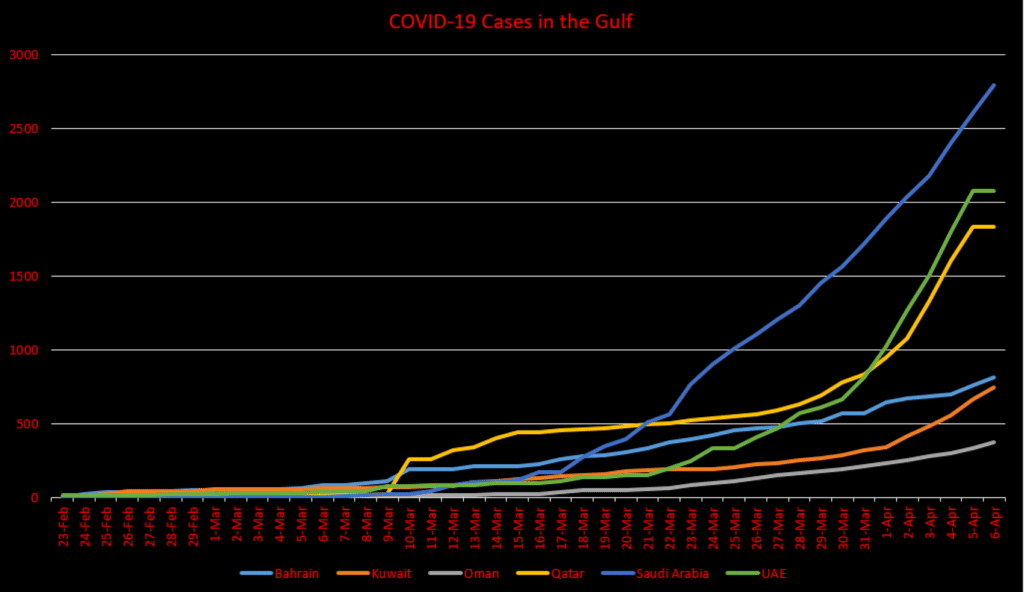

Saudi Arabia leads the Arab Gulf states with 2,795 confirmed cases and 41 deaths, followed by the United Arab Emirates, with 2,359 cases and 12 deaths, and Qatar, with 2,057 cases and six deaths. Bahrain has reported 811 cases and five deaths; Kuwait, 743 cases and one death; and Oman, 371 cases and two deaths. Only Yemen, currently in the midst of a brutal civil war, has yet to report a confirmed case.

The six coronavirus-stricken countries have all announced stimulus packages of varying sizes amid large-scale lockdowns to combat the virus. Riyadh, for its part, has imposed a curfew; closed most mosques, schools, and other public establishments; halted international flights; barred exports of medical products; indefinitely suspended certain categories of religious pilgrimage and blocked entry and exit to several cities, including Mecca and Medina; unveiled a $32 billion stimulus package; and raised its debt ceiling to 50 percent of GDP from 30 percent.

COVID-19 in the Greater Middle East

| Country | Cases | Deaths |

| Iran | 62,589 | 3,872 |

| Turkey | 34,109 | 725 |

| Israel | 9,248 | 65 |

| Pakistan | 4,009 | 56 |

| Saudi Arabia | 2,795 | 41 |

| UAE | 2,359 | 12 |

| Qatar | 2,057 | 6 |

| Algeria | 1,468 | 193 |

| Egypt | 1,450 | 94 |

| Iraq | 1,122 | 65 |

| Bahrain | 811 | 5 |

| Morocco | 761 | 47 |

| Tunisia | 623 | 23 |

| Kuwait | 743 | 1 |

| Lebanon | 548 | 19 |

| Oman | 371 | 2 |

| Jordan | 353 | 6 |

| Afghanistan | 281 | 6 |

| W. Bank & Gaza | 261 | 1 |

| Libya | 20 | 1 |

| Syria | 19 | 2 |

| Sudan | 14 | 2 |

| Somalia | 8 | 0 |

| Yemen | 0 | 0 |

Source: JHU Coronavirus Resource Center

Data current as of 5:00 PM, April 7, 2020.

Implications

The COVID-19 crisis has exacerbated economic woes for the oil-reliant region. Plummeting demand, coupled with a Russian-Saudi oil price war instigated by Riyadh, triggered the largest weekly crash in oil prices in nearly three decades. Meanwhile, the lockdowns necessitated by the pandemic are decimating industries such as tourism, transportation, and logistics, in which many Arab Gulf states have invested heavily as a means of diversifying state revenues away from oil. These dual challenges are severely straining government budgets, testing their capacity to maintain fiscal stability and preserve their currency pegs.

While their economic and fiscal conditions vary, overall, the Arab Gulf states cannot sustain “lower for longer” oil prices forever. Governments can buy time by cutting capital expenditure, dipping into their large stores of foreign reserves, selling off assets, or issuing debt. Eventually, however, they may have to cut spending. With economic growth and household incomes heavily dependent on government largesse, spending cuts could tip these states into recession and cause popular unrest. To make matters worse, locust swarms of biblical proportions have descended upon parts of the Persian Gulf, East Africa, and the Indian subcontinent, threatening food supplies.

What to Watch for

The Saudi- and Russia-led OPEC+ alliance plans to meet Thursday to discuss coordinated production cuts, reportedly in the range of 10 million barrels per day, or roughly 10 percent of global supply. While such a deal would not make up for lost demand, which in April is expected to drop by 20 to 30 percent year-over-year, it could boost prices enough to enable Gulf governments to ride out the pandemic.

Both Riyadh and Moscow have expressed their readiness for cooperation, but substantial Saudi and Russian cuts are likely conditional on participation from the world’s largest oil producer, the United States. President Donald Trump has lobbied his Saudi and Russian counterparts to cut output but has not pledged U.S. participation. Trump lacks the legal authority to order U.S. production cuts, which would face an added hurdle in U.S. anti-trust laws. Some American oil producers and state regulators – which do have the authority to order cuts – have called for U.S. participation, but others are resistant.

Still, market forces will cause at least some reduction in U.S. production, and dwindling storage capacity will eventually force most major producers to cut output. Going into Thursday’s meeting of major oil producers, the question is whether these variables can align to yield a Russia-Saudi agreement on substantial cuts, and whether even these cuts will be sufficient to stabilize an oil market facing a demand crisis with little end in sight.

Varsha Koduvayur is a senior research analyst at the Foundation for Defense of Democracies (FDD), where John Hardie is research manager. For more analysis from Varsha, John, and FDD, please subscribe HERE. Follow Varsha on Twitter @varshakoduvayur. Follow FDD on Twitter @FDD. FDD is a Washington, DC-based, nonpartisan research institute focusing on national security and foreign policy.