March 25, 2020 | Insight

Coronavirus Dashes Iranian Hopes of Emerging from Multi-Year Recession

March 25, 2020 | Insight

Coronavirus Dashes Iranian Hopes of Emerging from Multi-Year Recession

After a catastrophic year in which Iran’s clerical dictatorship watched the country’s economy shrink by 9.5 percent under pressure from U.S. sanctions, the first weeks of 2020 brought some hope that Iran might pull out of its multi-year recession. Then the regime, through its criminal malpractice in dealing with the COVID-19 pandemic, inadvertently set off a coronavirus bomb on Iran’s own economy. While the regime has rarely told the truth about either public health or the state of the economy, data from Iran’s Customs Organization provides the first concrete evidence that the economy is once again reeling.

The Trump administration reinstated most U.S. sanctions on Iran during the latter half of 2018. That year, GDP fell by 4.8 percent, while the rial plummeted and inflation shot upward. 2019 brought even worse news, yet the IMF forecast no further GDP contraction in 2020. That was before the pandemic unleashed chaos inside Iran, disrupted trade, and – with help from the Russian-Saudi oil war – cut oil prices in half.

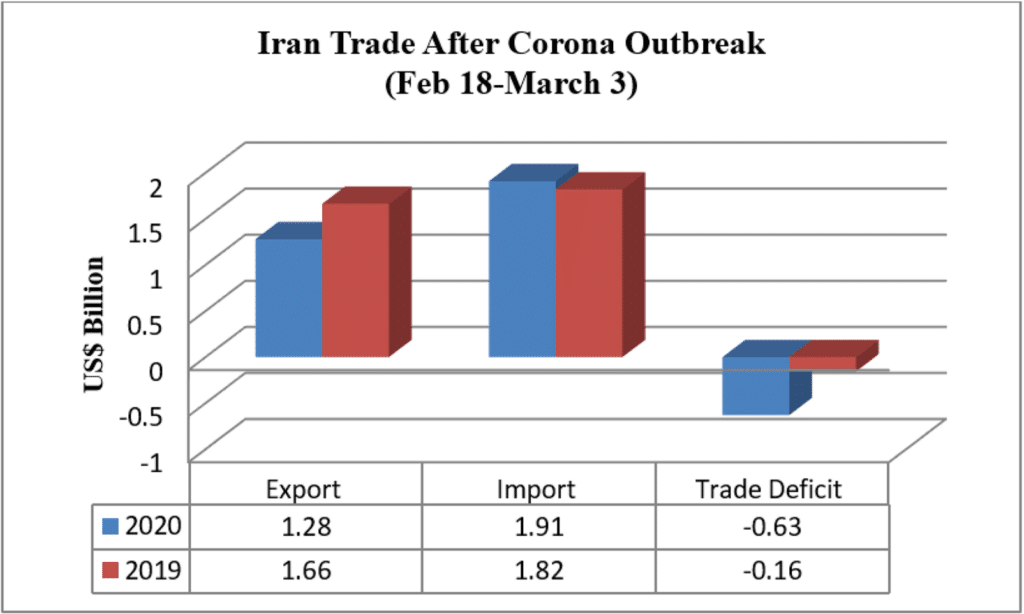

Now Iran is facing simultaneous negative supply and demand shocks, which inject uncertainty into the investment decision-making process. Under such conditions, a slowdown is unavoidable. Additionally, the epidemic will increase the trade deficit, at least in the short term, as Iran’s ability to export decreases while its need to import medical and essential goods grows. Thus, Tehran will have to tap into its substantial but decreasing currency reserves.

Early reports from Iran’s Customs Organization provide the first confirmation of this expected impact. Before the pandemic hit, Iran’s non-oil exports had begun to stabilize, decreasing only 5 percent from March 2019 to February 2020 (the first eleven months of the Persian year 1398). Yet from February 18 to March 3 of this year, Iran exported $1.28 billion of non-oil goods, a 30 percent reduction in comparison with the same period in 2019. Tehran’s imports during the same period were $1.91 billion, 5.1 percent more than a year earlier. This resulted in a trade deficit of $630 million, four times the $160 million deficit of the previous year.

In the case of Iran, plunging oil prices actually push down non-oil exports as well, since the latter include petrochemical products, whose price depends upon that of oil. From March 2018 to March 2019 (Persian year 1397), Iranian exports of petrochemical products amounted to $14.1 billion, or 32 percent (by value) of all non-oil exports. While the short-term effect of declining prices will depend on the type of contracts Tehran has with its customers, the long-term effect will be a decline in revenue.

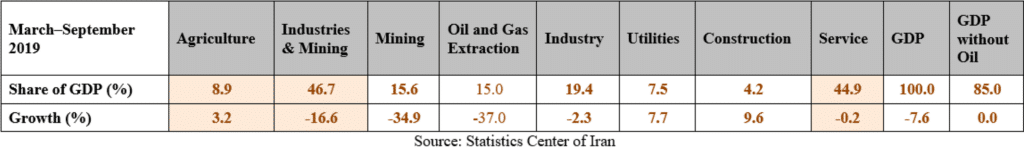

The oil and gas extraction sector will suffer, too, although it has already sustained extraordinary damage from U.S. sanctions, which by some accounts have cut Iranian crude exports by as much as 90 percent. From March 2019 to December 2019, the oil and gas extraction sector was responsible for 15 percent of Iran’s GDP. Thus, there is room for further contraction.

The epidemic is also likely to hit very hard in the service, manufacturing, and construction sectors. Services account for almost half of the country’s GDP. A study by Iran’s Ministry of Industries and Mines estimated the effect of the outbreak on 22 fields of business. 15 of them experienced more than a 60 percent decrease in demand, while the rest faced a 35 to 50 percent decrease. The timing is devastating, since the Persian New Year, Nowruz, which began on March 20, is the equivalent of America’s Black Friday for many in the service sector.

In the manufacturing sector, which accounts for roughly 20 percent of Iran’s GDP, Saipa, one of two major automobile production companies, announced in early March that it had halted its car production. The government in Iran has not yet ordered a mandatory closure of non-essential businesses, but various reports show that many manufacturing companies are operating below their usual capacity. Manufacturing activities traditionally slow during Nowruz holidays, so if the outbreak does not start to flatten by the second week of April, the effect on the manufacturing sector will be painful.

Even though the entire sector was under U.S. sanctions, construction was a bright spot for Iran last year, growing 9.6 percent from March through December and accounting for 4.2 percent of GDP. The sector’s growth was key to the resilience of Iran’s non-oil and gas economy, which Tehran hoped would push the country out of recession. Yet now, absent a massive stimulus package that the regime can hardly afford, the sector will sustain significant damage.

It is still too early to provide a meaningful forecast of the depth of Iran’s recession. However, it is very likely that Iran will face at least 1.5 to 2 percent of GDP contraction. Still, one cannot confidently rule out a more severe depression. In the absence of sanctions relief, loose enforcement, or cash injection into Iran’s economy by the IMF or World Bank, a 5 percent contraction like that of 2018 is a serious possibility. The picture will become clearer as time passes and more data becomes available. Regardless of its size, the third year of recession will shake the Islamist regime to its bones.

Saeed Ghasseminejad is a senior Iran and financial economics advisor at the Foundation for Defense of Democracies (FDD), where he also contributes to FDD’s Center on Economic and Financial Power (CEFP). For more analysis from Saeed and CEFP, please subscribe HERE. Follow Saeed on Twitter @SGhasseminejad. Follow FDD on Twitter @FDD and @FDD_CEFP. FDD is a Washington, DC-based, nonpartisan research institute focusing on national security and foreign policy.