April 25, 2019 | Policy Brief

Tehran Exports Its Petrochemical Products Despite Sanctions

April 25, 2019 | Policy Brief

Tehran Exports Its Petrochemical Products Despite Sanctions

From March 2018 through March 2019 (Persian year 1397), Tehran exported $14.1 billion of petrochemical products, despite Washington’s reinstatement of sanctions on the petrochemical sector in November. Petrochemicals represent 32 percent by value of Iran’s non-oil exports. Following the U.S. decision to stop issuing sanctions waivers for the purchase of Iranian oil, the regime’s reliance on non-oil exports will likely increase significantly.

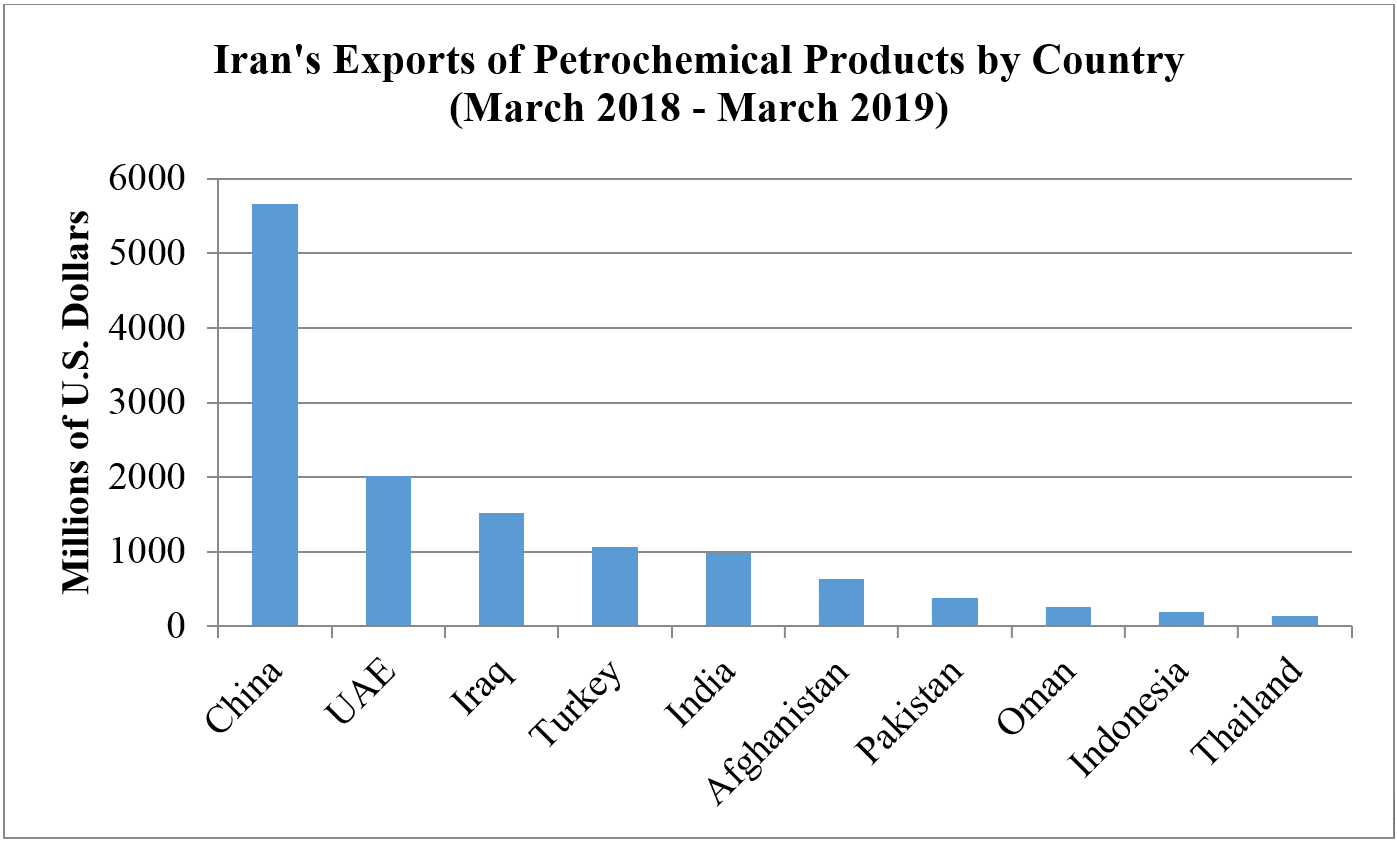

According to data published by the Iran Customs Organization, China imported $5.6 billion in petrochemical products from Iran, the most of any country. The UAE imported $2 billion, followed by Iraq with $1.5 billion and Turkey and India with close to $1 billion each.

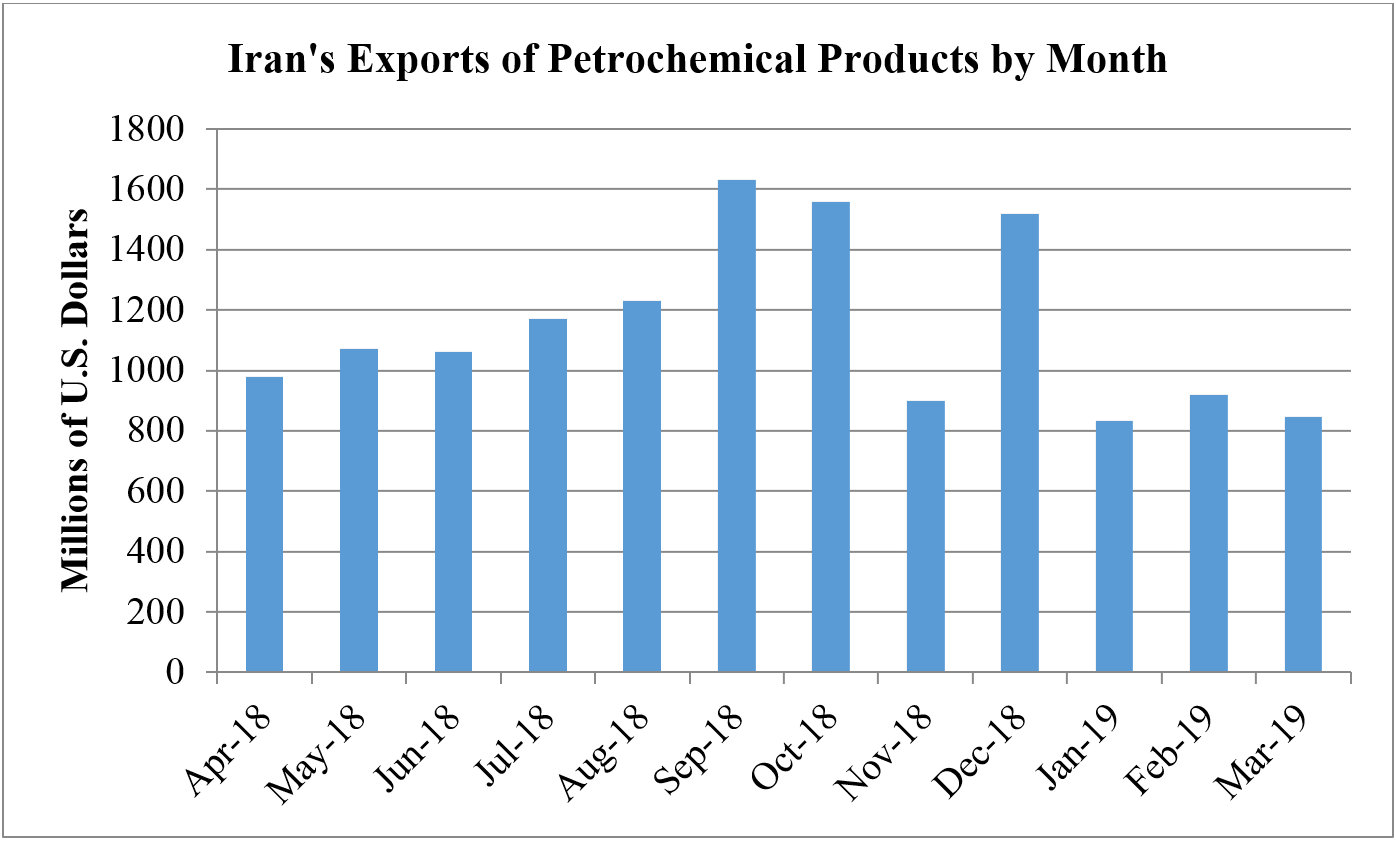

Prior to the re-imposition of sanctions, Iran exported an average of $1.2 billion of petrochemicals per month during the reporting period. Exports fell in November after the return of sanctions, but recovered the following month to October levels. Subsequently, they stabilized around $900 million per month during the final quarter of the reporting period.

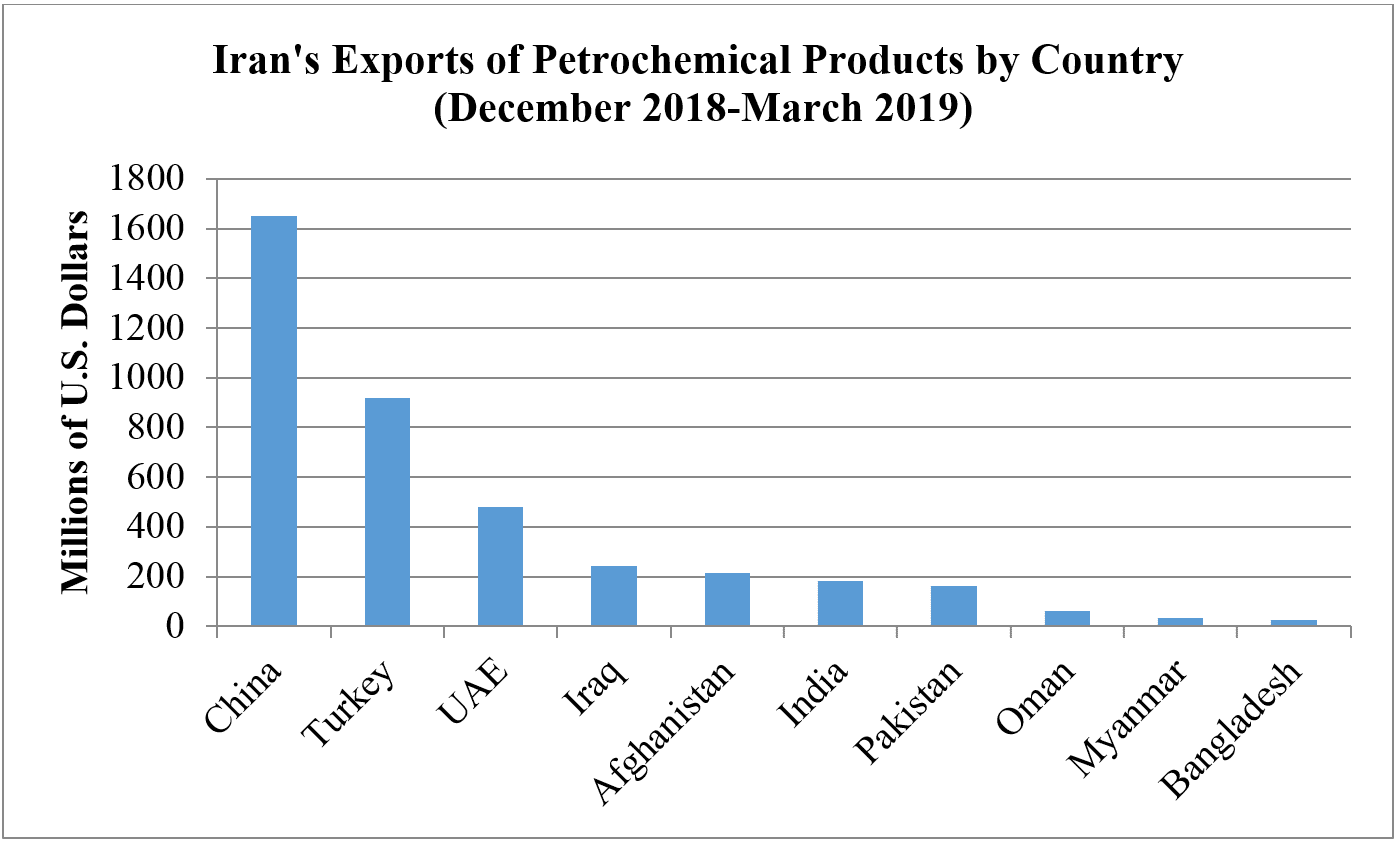

During the four full months following the return of sanctions, China remained Iran’s largest customer, purchasing $1.6 billion of petrochemicals. (The data for November does not distinguish exports from before and after the return of sanctions, which occurred on the fifth of the month.) The top ten importers remained the same, with the exception of Myanmar and Bangladesh taking the ninth and tenth spots from Indonesia and Thailand. Notably, Turkey’s average monthly imports increased by a factor of twelve, while Pakistan’s more than doubled. Uzbek imports also increased dramatically, but from an extremely low baseline. The UAE continued significant purchases despite its general alignment with U.S. policy toward Iran.

Belgium, Japan, Germany, Nepal, Australia, and Thailand cut their imports to zero after sanctions returned. Thailand had considerable imports of $137 million in the months before sanctions. Qatar, Indonesia, Taiwan, and Italy all reduced their average monthly purchases by more than 80 percent after the return of sanctions.

If the Trump administration is determined to pursue a policy of maximum pressure on Iran, it should rapidly improve enforcement of its petrochemical sanctions. As oil exports fall in the absence of waivers, Iran will become increasingly dependent on petrochemical exports for hard currency. Yet those exports have only fallen 20 percent since the re-imposition of sanctions.

The importers of Iranian petrochemicals continue to include both U.S. allies as well as rivals. Countries that share a land border with Iran – including Turkey, Pakistan, Iraq, and Afghanistan – remain among its best customers; so do two Persian Gulf states – the UAE and Oman – that share maritime borders. This geographical proximity means that Tehran could easily smuggle payments back home in the form of either foreign currency or precious metals. Curbing Iran’s petrochemical exports will require intense negotiation with countries that are prepared to find new suppliers. An aggressive use of sanctions and other punitive measures may be needed for those who refuse to comply.

Saeed Ghasseminejad is an Iran and financial economics advisor at the Foundation for Defense of Democracies (FDD), where he also contributes to FDD’s Center on Economic and Financial Power (CEFP). Follow Saeed on Twitter @SGhasseminejad. Follow FDD on Twitter @FDD and @FDD_CEFP. FDD is a Washington, DC-based, nonpartisan research institute focusing on national security and foreign policy.