November 9, 2018 | Policy Brief

New Iran Sanctions Leave Room for Additional Economic Pressure

November 9, 2018 | Policy Brief

New Iran Sanctions Leave Room for Additional Economic Pressure

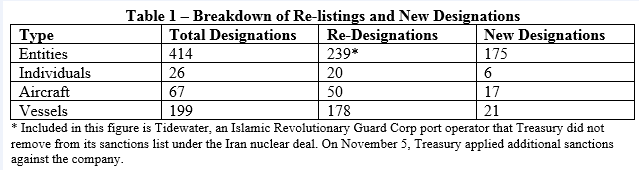

When the Trump administration re-imposed sanctions on the Islamic Republic of Iran on Monday, Treasury designated 706 entities, individuals, aircraft, and vessels for their role in a “broad range of malign activities.” This was an important step in dialing up the pressure on the Iranian regime. Two-thirds of these designations represent a re-listing of targets removed from Treasury’s sanctions lists as part of the 2015 nuclear deal (see Table 1). Many of the 219 first-time designees are components of Supreme Leader Ali Khamenei’s business empire, subsidiaries of financial institutions that support the Islamic Revolutionary Guard Corps, and companies and individuals responsible for Iran’s nuclear and ballistic missile programs. And yet, Monday’s sanctions are only a first step in an escalating economic pressure strategy.

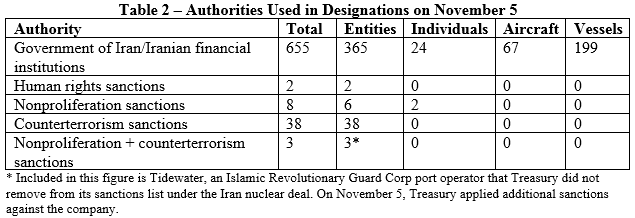

More than 90 percent of Treasury’s targets on Monday were slapped only with designations identifying them as owned or controlled by the Government of Iran or an Iranian financial institution (see Table 2). This includes the Atomic Energy Organization of Iran (AEOI), the agency with “operational and regulatory control” over Iranian nuclear activities. It is unclear why Treasury did not sanction AEOI and its affiliated entities under Executive Order 13382 for engaging “in activities or transactions that have materially contributed to, or pose a risk of materially contributing to, the proliferation of weapons of mass destruction or their means of delivery,” although it may be related to the administration’s decision to issue waivers for civilian nuclear cooperation.

Treasury only drew on its counterterrorism, nonproliferation, and human rights authorities to sanction 51 targets – 21 of which had not been previously sanctioned. Transacting with proliferation- or terrorism-supporting entities carries greater legal, regulatory, and reputational risk for multinational corporations and global banks than doing business with those designated only as owned or controlled by the Government of Iran. Treasury has therefore not yet fully utilized its authorities to apply economic pressure on Iran.

The Trump administration has now re-imposed sanctions on nearly 60 percent of the entities and individuals that received sanctions relief under the Iran nuclear deal. Excluding undesignated aircraft and vessels (at least some of which may be in dry dock or storage), the administration may have deferred action against 182 additional sanctions targets. While the administration has not indicated why these targets were not included in Monday’s designations, they could potentially represent the core of the next set of sanctions targets.

Shortly after Treasury’s announcement, National Security Advisor John Bolton noted that this is just the beginning of the administration’s economic pressure. There will be “sanctions that even go beyond” what had been introduced, and the Trump administration will not “be content with the level of sanctions that existed under Obama.” The Islamic Republic supports terrorism, proliferates weapons of mass destruction and their delivery systems, engages in money laundering and corruption, and denies the Iranian people their freedoms and human rights. With more sanctions on the way, the next rounds should leverage the full breadth of U.S. authorities to demonstrate clearly that the Iranian regime poses a threat to the global financial system and international business.

Annie Fixler is a policy analyst at FDD’s Center on Sanctions and Illicit Finance where Zachary Jutcovich is a senior congressional relations manager. Follow Annie on Twitter @afixler. Follow the Foundation for Defense of Democracies on Twitter @FDD and its Center on Sanctions and Illicit Finance @FDD_CSIF. FDD is a Washington-based, nonpartisan research institute focusing on national security and foreign policy.